As a small business owner, tax season may be stressful. There are several financial records to keep track of, and it can be difficult to ensure that everything is correct, up to date, and filed on time.

By being organized and keeping accurate records all year, you can make the tax filing process much easier, which is where Intuit QuickBooks comes in.

QuickBooks is an accounting software that assists small business owners in tracking income and expenses, creating financial reports, and preparing for tax filing.

It can assist in simplifying the financial management process by automating chores like transaction monitoring and report generation, ensuring that you have an exact record of all business spending come tax season.

In this article, we’ll look at how QuickBooks can help you streamline your tax season and offer ideas on how to use it most effectively.

READ ALSO: The Best Global Payroll Services for Your Business

3 QuickBooks Features That Help Small Businesses Succeed During Tax Season

QuickBooks has so many features, but here are my top 3 favorite features that help me as a business owner, during tax seasons. Visit QuickBooks today and let me know which one is your favorite feature and how it helps you during tax season.

#1. Tracking Your Business Expenses

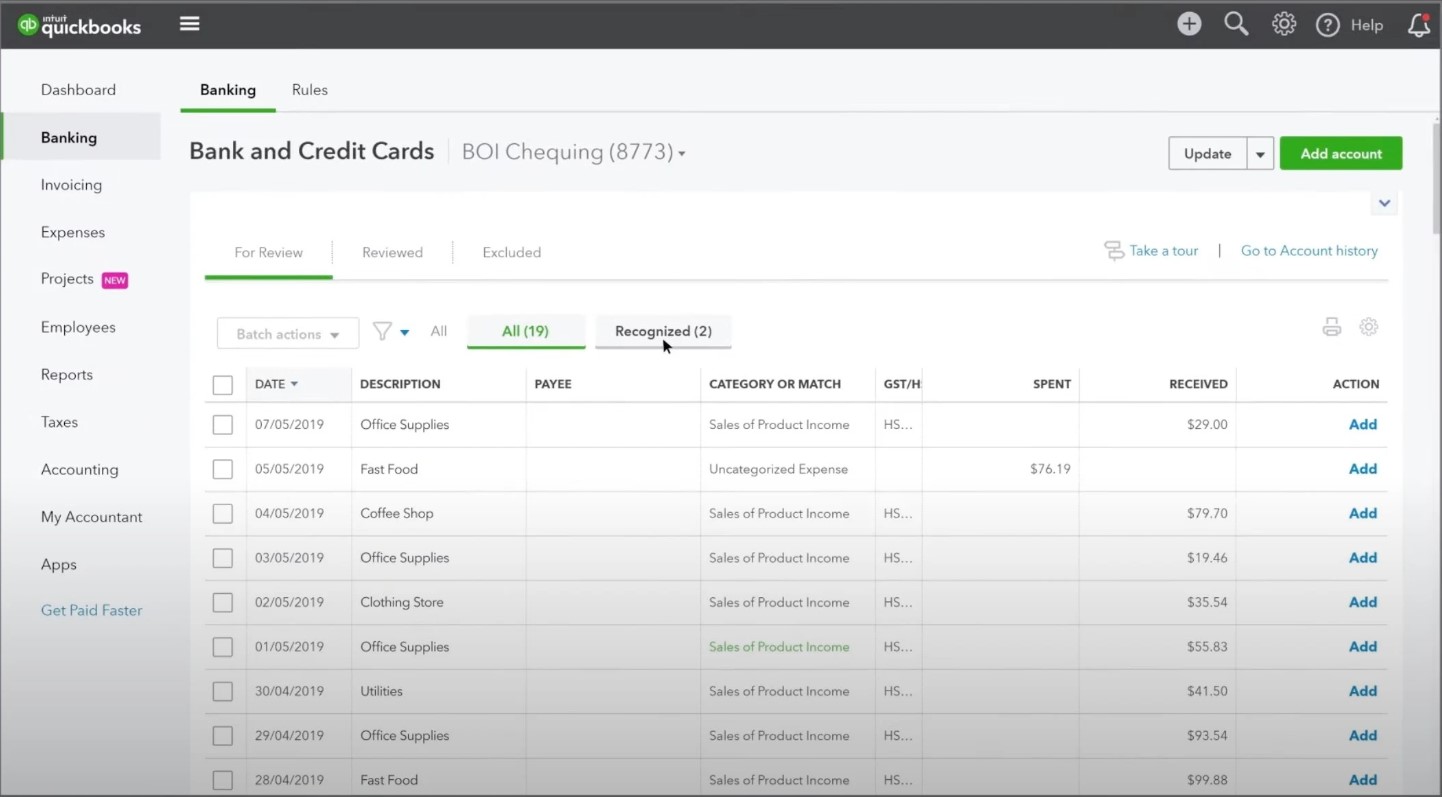

The ability of QuickBooks Online to track all business spending year-round is one of its greatest features.

This can be especially useful since you’ll need to arrange and submit all of your business costs when it comes time to file your taxes.

You may organize your spending with QuickBooks Online, which makes it simpler to keep track of them and guarantee that you correctly claim all of your tax deductions.

It is crucial to classify expenses in QuickBooks Online accurately and consistently. Your financial records will be well-organized and simple to find and retrieve as a result.

To ensure that your expenses are accurately claimed on your tax return, you should also confirm that you are tracking all of your expenses using the appropriate tax codes.

For tax season to go well, financial data must be accurate and current. The number of detailed reports that QuickBooks Online produces, including balance sheets and profit and loss statements, make tax preparation easier.

These reports can also assist you in making wise financial decisions by offering insightful information on the financial health of your company.

QuickBooks Online provides various tax-related reports, including a Profit and Loss by Customer report and a Sales Tax Liability Report.

These statistics can help you identify the most profitable customers and keep track of all your sales tax obligations.

You can also tailor reports to your individual business requirements, such as adding or removing columns or filtering data by category.

Customizing reports in QuickBooks Online allows you to get the most out of your financial data. You can add, remove, or edit columns, adjust the date range, and filter data to display only the information you’re looking for.

Customizing reports allows you to view the financial data you need to make smart business decisions and streamlines the tax preparation process.

READ ALSO: Best LLC Formation Services and Agencies in the USA

#2. Workflow Automation

QuickBooks Online automates all your tasks, therefore, reducing the time and stress associated with accounting for small business owners.

The software allows you to send periodic invoices and payment reminders, sync data from bank and credit card transactions, and reconcile expenses, eliminating the need to do so manually.

Manual data input is not only tiresome and time-consuming, but it also allows for human mistakes, which can result in inaccuracies or redundancies in your books.

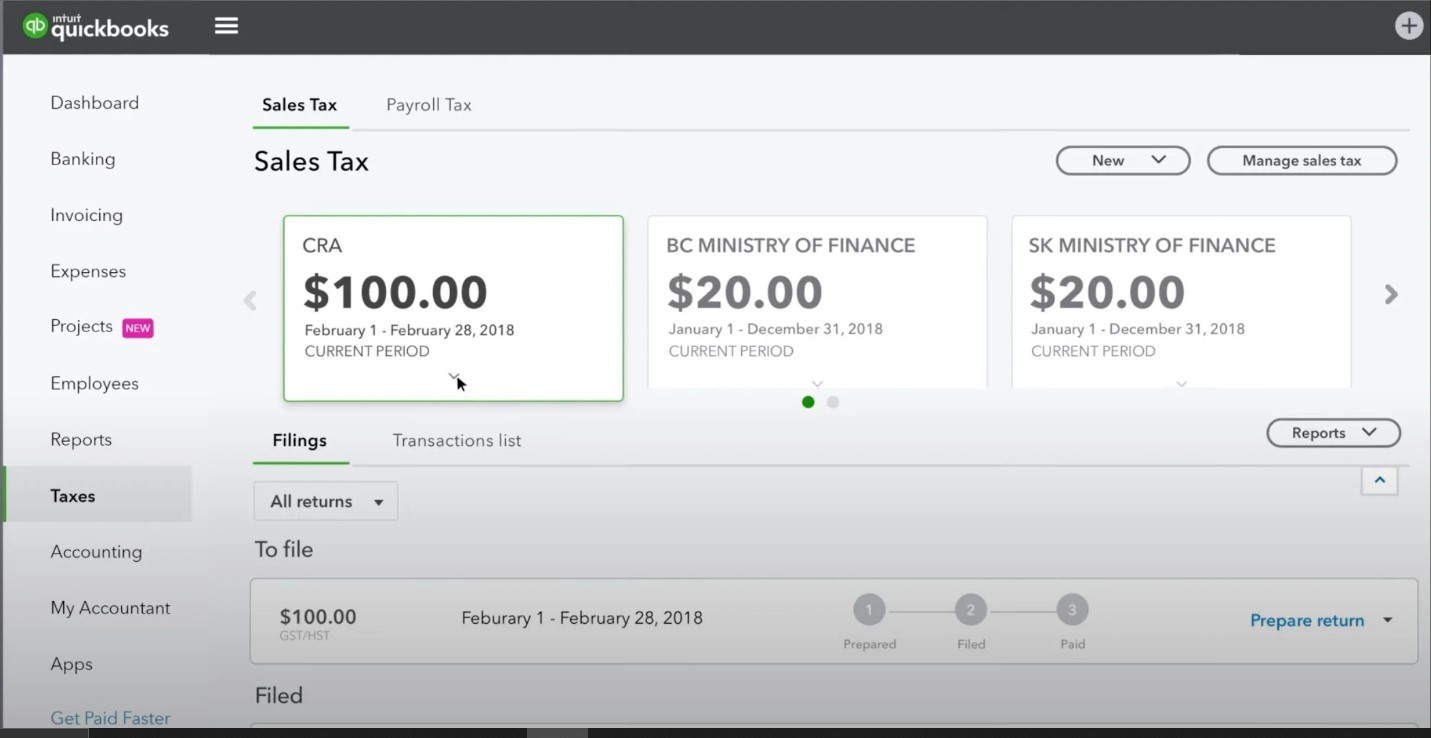

#3. Preparing for Tax Filing

QuickBooks Online can help speed up and simplify tax preparation by automating operations like creating W-2 and 1099 forms. This can save you time and ensure that your tax returns are accurate and on time.

Preparing for tax filing using QuickBooks Online is simple.

The cloud-based accounting software includes a Tax Center, which provides a checklist of everything you’ll need to submit your taxes, including a summary of your income and expenses, tax forms, and payments.

Here are the steps to prepare for filing your taxes:

- Begin by examining your revenue and expense reports to confirm that all transactions are properly categorized. This can assist you in identifying any errors or missing information that may need to be fixed before completing your taxes.

- Make a profit and loss statement for the year to date. This report provides an overview of your company’s sales, costs, and net income or loss for the year. To obtain this report, select “Reports” from the left-hand menu, then “Profit and Loss” from the “Business Overview” section.

- Create a balance sheet report to provide an overview of your company’s financial situation. This report will display your assets, liabilities, and equity as of a specified date. To obtain this report, select “Reports” from the left-hand menu, then “Balance Sheet” from the “Business Overview” section.

- Finally, verify your tax returns to ensure that all tax payments and paperwork were properly filed. QuickBooks can generate several tax-related reports, including sales tax and payroll tax statements. To obtain these reports, select “Reports” from the left-hand menu, then “Taxes” under the “Business Overview” section.

READ ALSO: USA Payroll Calculator (Hourly Paycheck Calculator by State)

To maintain accuracy and avoid frequent mistakes during tax preparation, small business owners should follow these best practices throughout the year:

- Keep accurate records all year, including receipts, invoices, and bank statements. QuickBooks can help you track business transactions and keep your records up to date.

- Ensure that all transactions are properly categorized. This can help you generate accurate reports and file your tax returns accurately.

- Check all employee and contractor information, including Social Security numbers and addresses, before creating W-2 and 1099 forms.

- Before submitting any tax forms or reports to the IRS or other tax authorities, ensure that they are accurate. This will help you avoid penalties and other complications in the future.

- Consider dealing with a tax professional or accountant to ensure that your taxes are properly filed and to receive advice on how to reduce your tax liability.

Small company owners can decrease the burden of tax season by following these guidelines and using QuickBooks Online to streamline the preparation process.

Benefits of Using QuickBooks During Tax Season

Compared to manual tax preparation methods, QuickBooks Online provides a number of advantages for small business owners.

Some of the primary benefits are:

- Time savings: QuickBooks may help business owners save time throughout tax season by automating various tax-related procedures and creating customized reports. QuickBooks also provides a free tool for calculating sales taxes.

- Improved accuracy: QuickBooks’ ability to log transactions and provide accurate reports can assist business owners in avoiding frequent mistakes and ensuring that their tax returns are submitted accurately.

- QuickBooks helps small business owners to personalize their financial reports to meet their individual requirements. This flexibility can be especially valuable when preparing for tax season since business owners can generate reports that highlight the information required to file their taxes correctly.

- Easy collaboration: If you work with an accountant or other financial professionals, QuickBooks can help you work together throughout tax season. Giving others access to your QuickBooks account allows them to examine and collaborate with your financial data without having to provide paper papers.

- Centralized data: QuickBooks stores all of your financial data in one area, making it easy to access and organize. This can be a huge assistance during tax season since it reduces the stress of looking for receipts and other financial paperwork.

In addition to the features listed above, QuickBooks Online has an intuitive user interface that allows small business owners to easily access and manage their money.

The platform’s dashboard offers a fast snapshot of the company’s financial health, including critical parameters such as cash flow, expenses, and profit and loss.

This is especially useful during tax season since it allows business owners to immediately identify areas where they may need to make changes to better their tax situation.

Furthermore, QuickBooks is constantly updated to maintain compliance with tax legislation and accounting standards, lowering the likelihood of errors or penalties.

To further optimize business operations, the platform interfaces with a variety of different business tools, such as payment processors and inventory management software.

READ ALSO: UK Business Formation/Registration Guide

QuickBooks Online Setup Guide

We followed the QuickBooks online setup process to better understand how to get started as a beginner. In QuickBooks Online page, you first enter your company’s information and fiscal year.

Following that, you select one of two accounting methods: cash or accrual accounting, as well as your primary currency.

Next, choose your company logo and default “net payment” invoice terms. For example, if you expect clients to pay invoices within one month of receipt, use Net 30.

If you sell products, you will also need to enable the sales tax function on the Tax tab. You can track your inventory using a variety of inventory management approaches, including first-in, first-out and last-in, first-out.

Once you’ve decided on each of the options, create an invoice in QuickBooks to test the software and see how it works.

We recommend that you submit a sample invoice to yourself or a staff member. If everything goes as planned and the invoice is received correctly, you’re ready to use the software.

In Summary

Tax season is always a busy time for small business owners. Fortunately, QuickBooks Online streamlines the process by giving a complete answer to all tax-related complications.

QuickBooks Online can assist expedite and manage the entire tax process. Small company owners can save time and effort by utilizing QuickBooks Online to manage costs throughout the year, generate reports, and prepare for tax filing.

If you own a small business, you should look into how QuickBooks Online can help you ease tax season and enhance overall financial management.

By taking advantage of QuickBooks Online’s many features and benefits, you can simplify tax season and eliminate the stress that usually comes with it.

Businesses may utilize its user-friendly tools and features to keep their finances organized, eliminate errors, and boost their chances of receiving the largest tax refund possible.

Use QuickBooks Online to its full potential, not only to help you manage tax season more smoothly but also to set the road for future business success.

READ ALSO: How to Start a Blog & Make Money Online ($250k Per Month)

QuickBooks Online FAQs

Accountants utilize accounting software such as QuickBooks Online Accountant to manage many clients’ books from the one login helping them to optimize their accounting workflow and boost efficiency.

QuickBooks Online integrates with hundreds of third-party applications, including the best email marketing, e-commerce, best customer relationship management software, payment processing, best payroll services and time tracking platforms.

These integrations can save you time by connecting the software to the business programs you already use, thus allowing you to automatically import, export and sync data in real time.

Accountants can sign up for free to use QuickBooks Online Accountant for their accounting firms.

Accountants may help their small business clients get started with QuickBooks Online by offering special incentives.

Very helpful, thanks