This article is about Bizee Business Registration in the USA. Yes; before you incorporate in America, its wise to weigh your options first to know which agency is the right one for you and your business type.

When it comes to business registration in America, Bizee (formerly Incfile) is a leader in the industry. So, yes, you can't go wrong with them, as far as we know.

Keep reading to see how to register your business in the US with Bizee. No matter the type of business registration (LLC, C-Corp, S-Corp, Non-Profit) etc.

READ ALSO: Best LLC Formation Services and Agencies in the USA (2025 Top Ranked)

Types of Business Registrations in the USA

Starting a business in the USA involves several critical steps, one of which is choosing the right type of business registration.

This decision influences your legal obligations, taxation, personal liability, and ability to raise capital.

Whether you're an entrepreneur launching your first venture or a small business owner looking to expand, understanding the various business registration types is essential.

1. Limited Liability Companies (LLCs)

- This entity type offers protection similar to corporations, separating personal and organizational liabilities, especially important for entities engaging in widespread charitable activities.

- There's no limit on owners; flexible management options allow for tailored operational control, suitable for diverse business models.

- There are benefits from pass-through taxation, with an option for corporate taxation, offering tax flexibility to members.

- It provides strong protection of personal assets from business liabilities, crucial for businesses with substantial risk.

- When it comes to tax, it is moderate, with the potential need for reformation upon membership changes, depending on state laws.

- This is the type of entity suited for funding through member contributions and bank loans, though may face challenges in attracting external investors.

- This entity type is a great option for entrepreneurs and startups seeking operational flexibility, personal liability protection, and tax options, especially in high-risk sectors.

2. S-Corporations (S-Corps)

S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.

- It balances corporate structure with operational flexibility, subject to certain formalities for tax status maintenance.

- When it comes to ownership, it is capped at 100 shareholders who must be U.S. residents, introducing limitations on investment diversity and scale.

- Offers pass-through taxation to avoid double taxation, with benefits for salary and dividend tax planning.

- It ensures shareholders’ personal assets are protected from company liabilities, providing a safeguard for personal wealth.

- There's a strict IRS criteria for S-Corp status, including operational guidelines and reporting standards.

- You can have access to capital through a single class of stock and loans, with some limitations compared to C-Corps.

- This is a great option for small to medium businesses that meet the IRS requirements, looking for tax advantages without the complexity of a C-Corp.

3. C-Corporations (C-Corps)

A C-Corporation (C-Corp) is a legal structure for a corporation in which the owners, or shareholders, are taxed separately from the entity.

- This type of entity faces the highest level of regulatory and operational requirements, ideal for those able to navigate complex structures.

- It can have unlimited ownership with no nationality restrictions, allowing for global investment opportunities.

- This type of entity encounters corporate taxation and potential double taxation on dividends, offset by a wider range of deductible business expenses.

- It offers maximum protection for owners from personal liability, a critical factor for businesses with significant risk exposure.

- It demands extensive record-keeping, governance standards, and shareholder meetings, suited for large-scale operations.

- When it comes to financing, it is extensive, through public and private stock offerings, which is ideal for raising significant capital.

- This is a great option for larger companies or those planning to go public, seeking to maximize capital raising opportunities and benefit from the corporate structure.

4. Non-Profit Organizations

A nonprofit organization is an entity that is created and operated for charitable or socially beneficial purposes rather than to make a profit.

- This entity type is governed by strict regulations aimed at non-profit goals, limiting operational flexibility in favor of mission fulfillment.

- It operates without traditional owners, managed by a board focused on the non-profit's mission, emphasizing charitable activities over profit.

- It can achieve tax-exempt status, avoiding many forms of taxation and enhancing the ability to receive tax-deductible donations.

- It offers protection similar to corporations, separating personal and organizational liabilities, especially important for entities engaging in widespread charitable activities.

- It is subject to non-profit-specific regulations and reporting, ensuring operational transparency and accountability.

- It is reliant on donations, grants, and fundraising efforts, focusing on supporting the mission rather than generating profit.

- This is a great option for organizations dedicated to charitable, educational, religious, or scientific missions seeking tax advantages and societal impact over profit.

How to Register a Business in the USA

This is a step-by-step guide on how to register a business in the US from anywhere in the world using the Bizee registration agency.

You can form an LLC, register a C-Corp business type, register an S-Corp business type, or even a Non-Profit Company.

All you need to do is follow my step-by-step guide and you will be done in no time.

Step 1: Visit www.bizee.com and select the type of business you want to register.

For the sake of this tutorial, I will be forming an LLC to demonstrate how to do it.

Select the entity type you want to register and then select the state where you want to register your business in. You can actually select any state you want and then click on Start My Business.

Step 2: Select a Business Formation Package.

Bizee has three (3) type of packages and the two most important packages in my opinion is the Standard and Premium Package.

Go ahead and select any of the mentioned two and proceed.

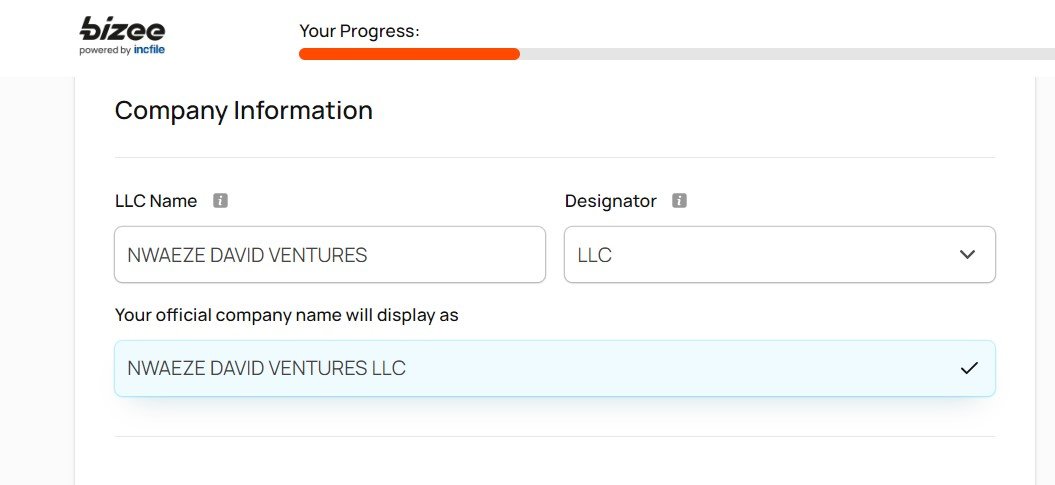

Step 3: Enter the name of your business.

When you enter your name, the system will automatically check if the name is available for registration. If it is not available, you'll be notified immediately so you can make a change.

As explained in the image above, the members (owners) option is the one to select if you are the owner of this business. However, if you appointed someone to manage this process for you, they can select the other options.

Step 4: Enter your contact details.

Remember, you are not limited by your location; So, if you are not from the USA, go ahead and change the phone number flag to your country's location and then enter your phone number, email address and name.

To get a USA phone number, visit any of these websites:

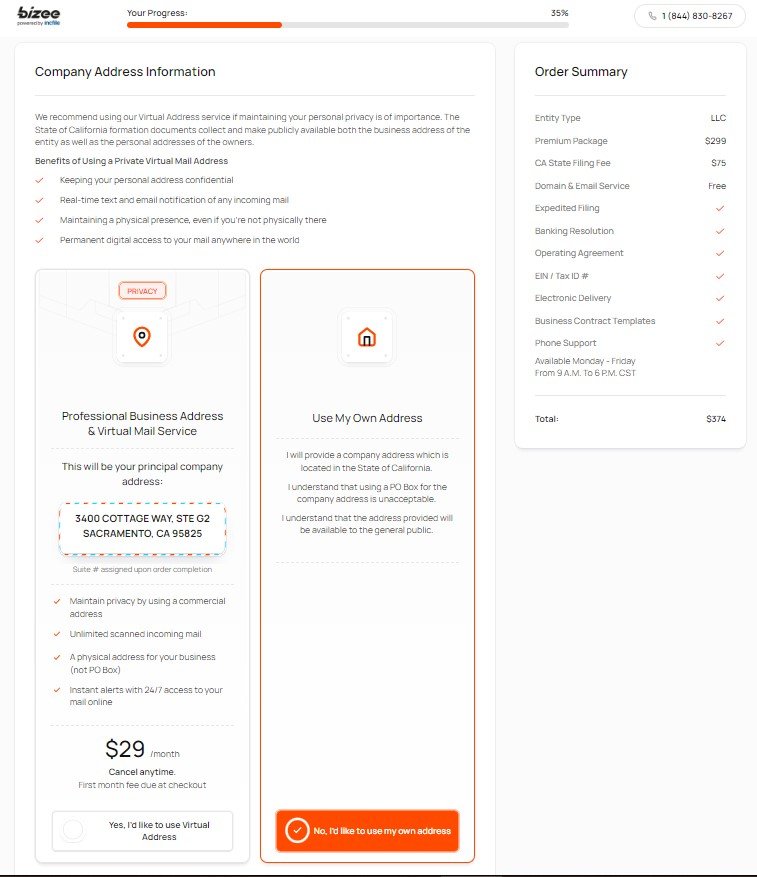

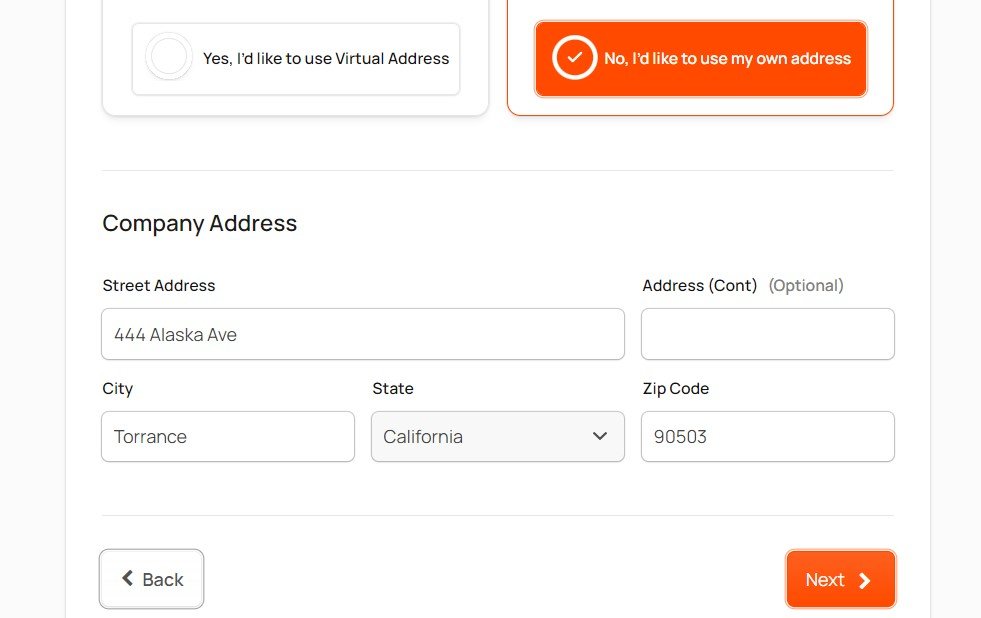

Step 5: Select your Company Address Information.

You need a USA address for this, so you have two options here. Option #1 is to select the virtual address package by Bizee.

Option #2 is to open a virtual USA address for free with Shipito and then use the assigned address to continue your registration.

Go ahead and enter your USA virtual address to proceed.

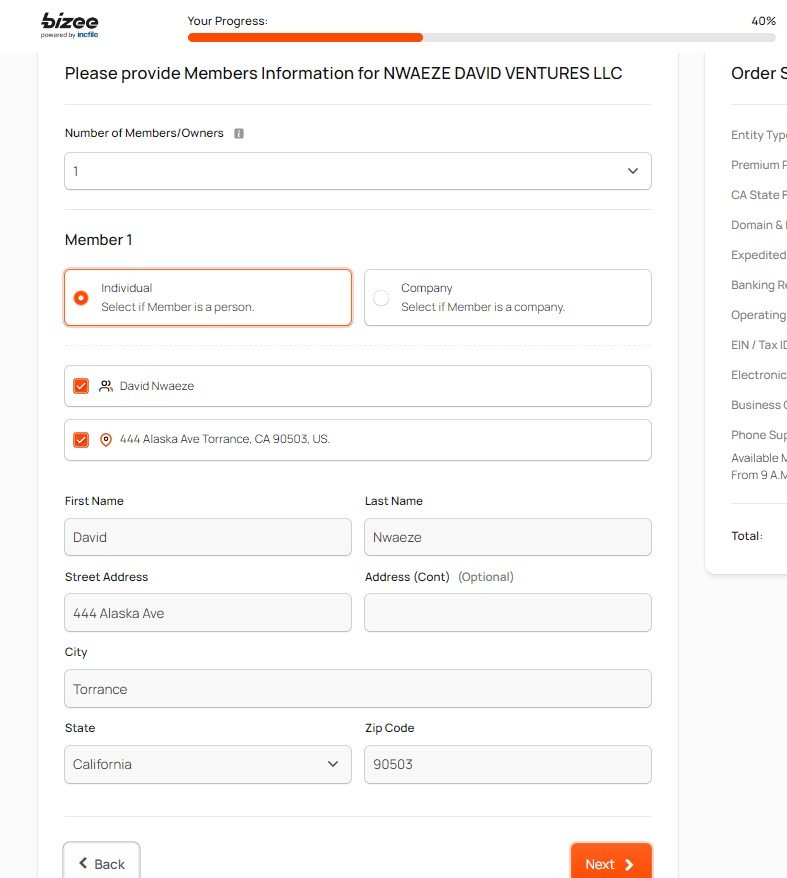

Step 6: Provide your Company Members Information.

Select the number of members (owners) for your business. If you are the only one, then go ahead and select 1.

Depending on the number you select, forms will be displayed for you to enter your member information. If you are the only one, do ahead and enter your information.

I believe you have entered these information before, so all you need to do is select the box that shows your name and address.

All your details will be automatically populated in the required boxes.

Step 7: Select a Registered Agent for your Business.

Go ahead and select Bizee as your registered agent unless you already have someone else you paid to do this for you.

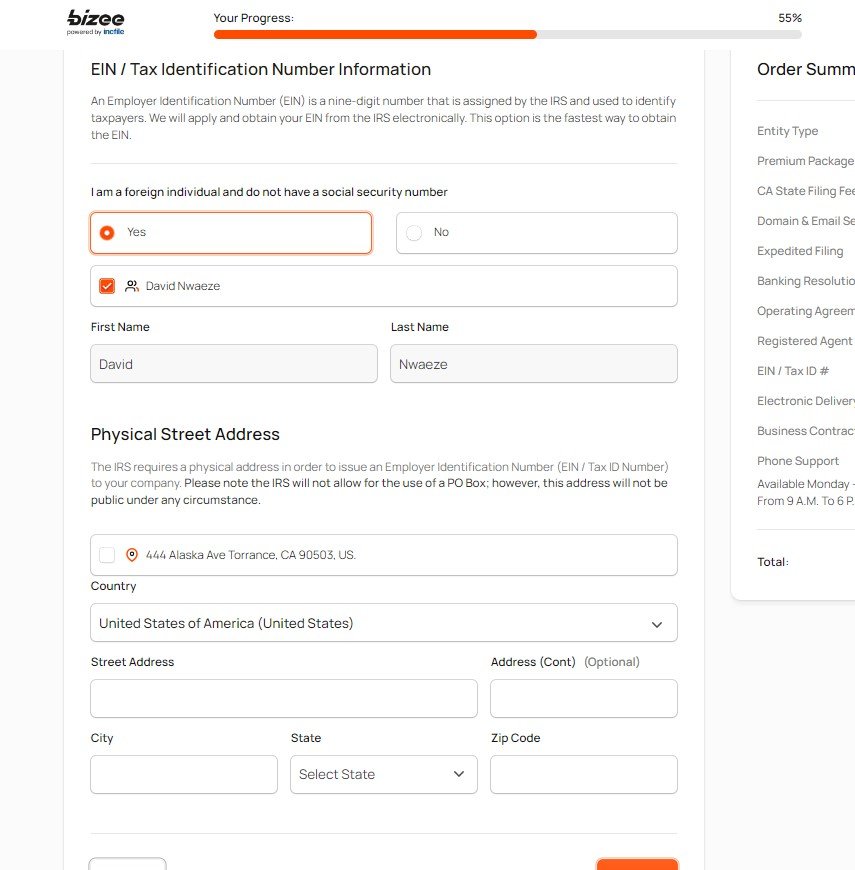

Step 8: Enter your EIN/Tax Information.

If you are not a US citizen, go ahead and indicate it here.

Also, make sure that the address you enter here is the current place you are located right now. In other words, select your country location and address here.

NOTE: As a non-US citizen, the timeframe to obtain the EIN could take up to 3 months if not more, so you'll need to be patient.

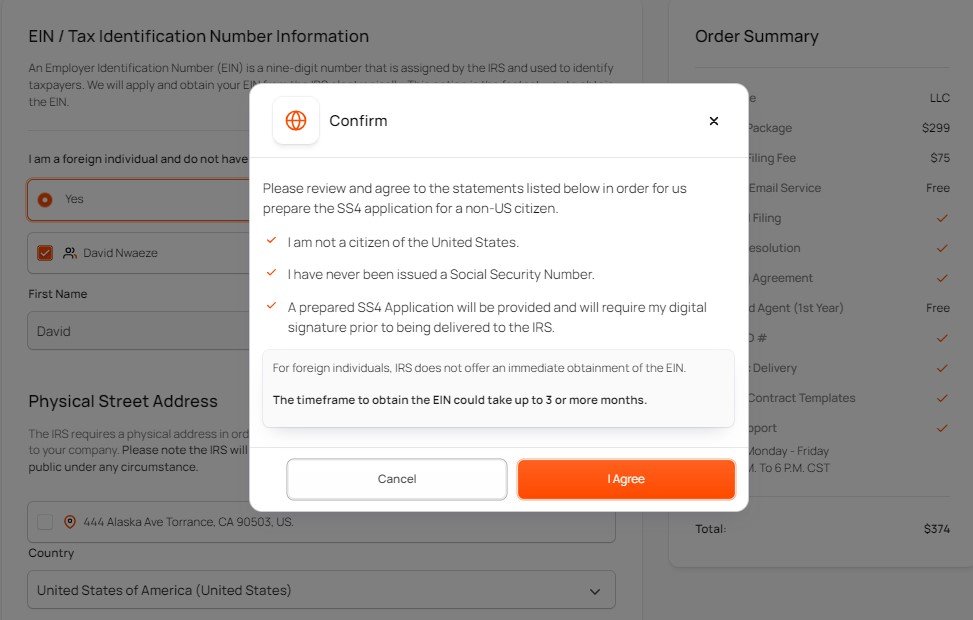

Step 9: Setting up Small Business Banking.

One of the great things about Bizee is the fact that they have everything you'll ever need to start your business officially in the USA, and that includes a Business Banking solution for your business. It is Free!

So, go ahead and select it and then proceed to the next step.

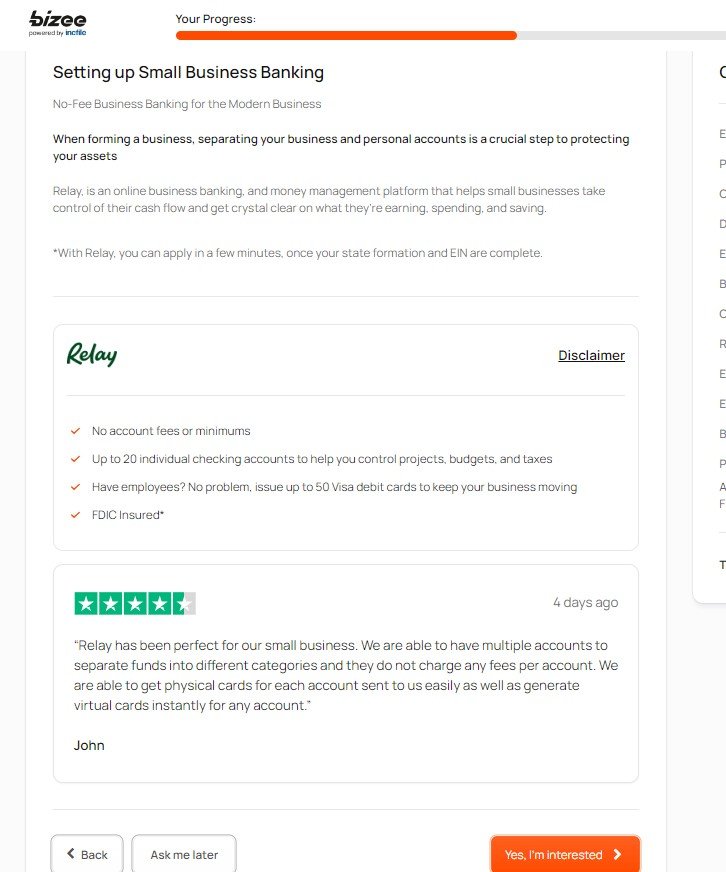

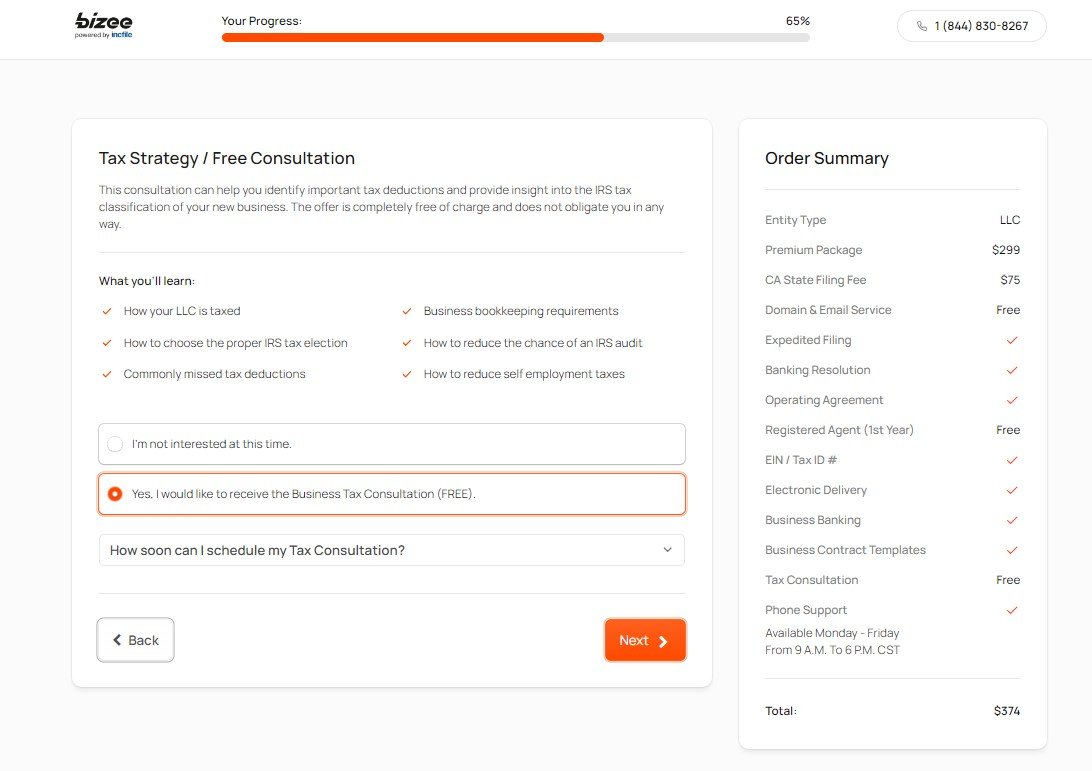

Step 10: Tax Strategy / Free Consultation.

This is a free package, so why not? Go ahead and select it and then continue.

Step 11: Business Licenses and Permits.

It is important to have a federal, state and local business license for your company, so if you can do it yourself, fine.

But, if you can't do it yourself, it's best to allow Bizee to handle that for you.

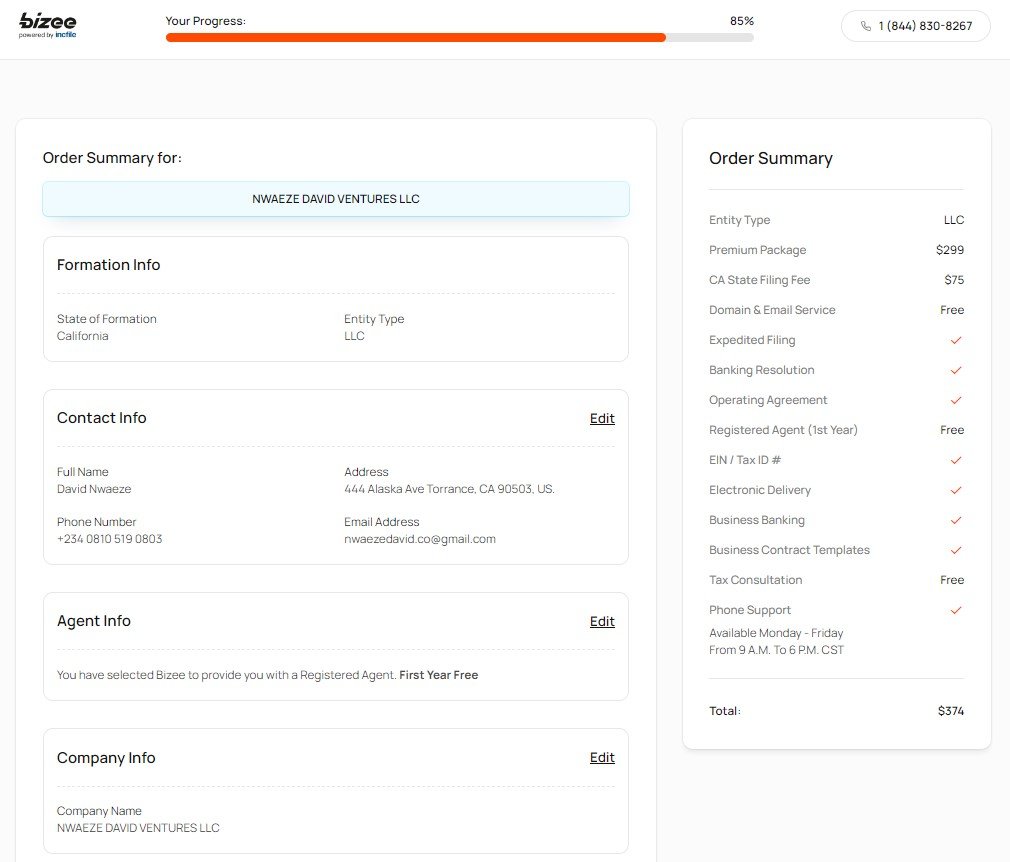

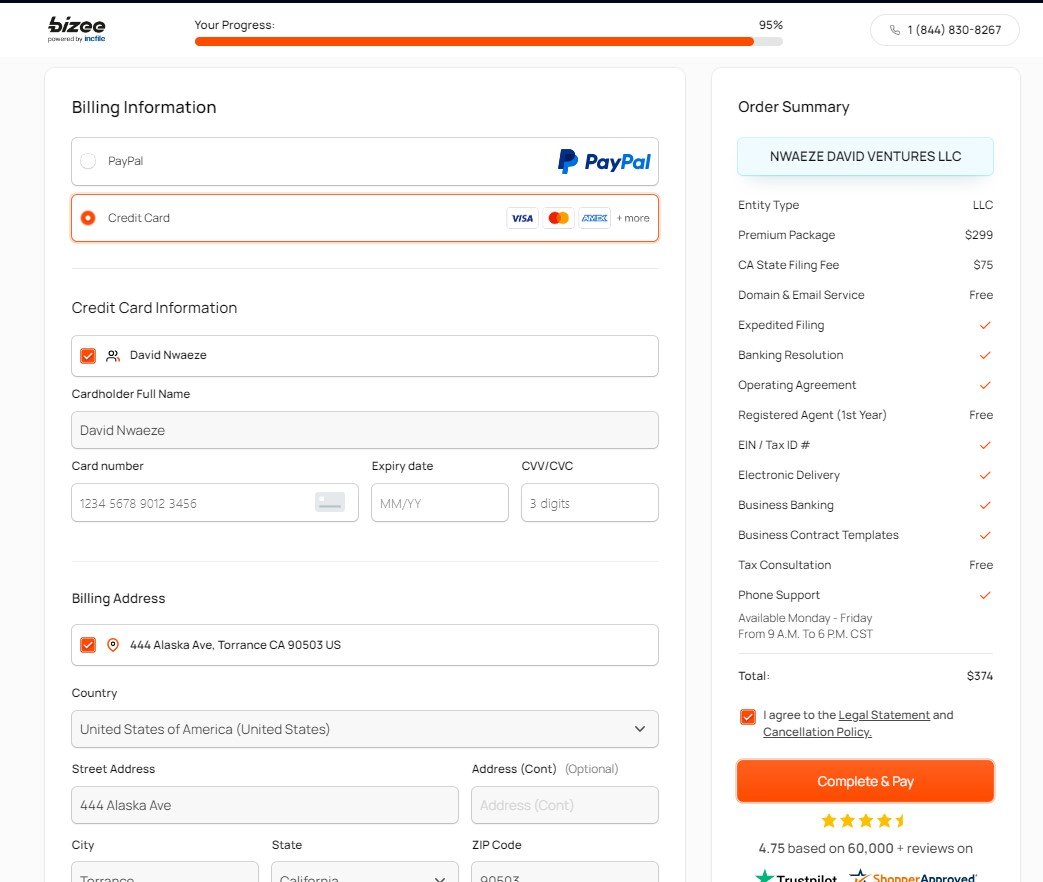

Step 12: Review and Make Payments.

Go through all the information you entered and make sure everything is in order.

Enter your payment details and complete your payment. Once this is done, your business registration will commence.

Congratulations! You just registered your business in the USA.

READ ALSO: UK Business Formation/Registration Guide

FAQs about Bizee Business Registration in the USA

A sole proprietorship is the easiest and least expensive to establish, making it ideal for solo entrepreneurs.

Yes, many businesses start as sole proprietorships or partnerships and later transition to LLCs or corporations as they grow.

No you don't.

However, while its not mandatory, consulting an attorney can ensure compliance with state and federal regulations.

Yes you can.

If you follow through the steps in this article, you will be able to do just that.

Bizee Alternatives

Tailor Brands

Tailor Brands is a platform that simplifies every step of starting, managing, and growing a business in the USA.

They have grown to become America's favourite agency for startups.

They have helped hundreds of thousands of business owners like you to form an LLC in the US without hassle.

BetterLegal

BetterLegal has a reputation for being fast when it comes to business registrations and company filing; Your company will be official in just 2 business days.

Unlike Bizee and ZenBusiness, you’ll have to pay for “Registered Agent Service” which is priced at $10/month or $90/year. But, every other thing is pretty much covered.

NorthWest Registered Agent

NorthWest Registered Agent is a family-owned business with the best customer service when compared with other business registration services.

Founded in the year 1998, they have what I call super-familiar experience when it comes to business registrations in the US.

Firstbase

Firstbase.io was founded in 2019 and has helped over 10,000 founders in the United States to incorporate their business in the US.

Firstbase is what you can call an all-in-one Company OS that helps define how founders across the globe launch, manage and grow their businesses.

ZenBusiness

ZenBusiness is a unique business registration service provider in the US that is popular for its simplicity.

They make the process look easy and simple. All you have to do is fill out a form and they will handle everything.

When it comes to pricing, they are one of the most affordable options and also very fast business fillings.

Business Anywhere

Business Anywhere is somewhat of an All-in-One Business Solution system which is super nice and important for young entrepreneurs that have zero experience.

You can easily get everything you need for your business all in one place and that will make business management to be easy and flexible.

Just like all other mentioned business registration agencies in this article, Business Anywhere is perfect for non-us citizens to form an LLC in the US.

In Summary

When it comes to business registration in the USA, everyone in the world today now have a chance to do business in America, thanks to Bizee and other agencies.

As you proceed, choosing the right type of business registration is a foundational step in building a successful business.

By understanding the pros and cons of each structure and aligning them with your goals, you can set your business on the path to growth and sustainability.

Don’t hesitate to seek professional advice to navigate this critical decision.

Research your state’s specific registration requirements.

Draft a business plan to guide your structure choice.

Consult with a business advisor or attorney.

Ready to Level Up Your Business Skills?

Join my online school, Online Income Academy, for more expert guides, tutorials, and strategies to help you build a successful business. Sign up today!