Let's do a quick Airwallex yield review for 2025. Cash flow management is one of the most overlooked growth levers in business.

For companies operating globally, every unused dollar sitting idle in your account is an opportunity.

That’s where Airwallex Yield comes in, a financial feature designed to help you earn interest on your USD balances, all within the Airwallex ecosystem.

In this in-depth review, we break down how Airwallex Yield works, what makes it unique, the current APY, eligibility requirements, risks involved, and how it compares to similar business savings or interest-bearing accounts.

If you're a business owner looking to make your cash work smarter, not just harder, this article is for you.

READ ALSO: Airwallex vs Stripe (2025): Which is Better for Global Businesses?

What is Airwallex Yield?

Airwallex Yield is a financial product that allows businesses to earn interest (up to 4.2% APY) on idle USD balances stored in their Airwallex business account.

Instead of letting your money sit in a non-yielding account, Airwallex partners with U.S.-regulated financial institutions to give you a return on your unused funds, while still allowing liquidity and access to those funds when you need them.

How Does Airwallex Yield Work?

- When you opt in, a portion of your USD balance is moved into an interest-generating account.

- Interest is accrued daily and paid out monthly.

- You can withdraw the funds at any time—no lock-up periods.

- All assets are held with regulated U.S. financial partners and are not used for loans or leveraged investments.

Your funds remain accessible, giving you a lot of flexibility and earning power at the same time.

READ ALSO: Airwallex Business Account Review (Features, Fees and Alternatives)

Current Airwallex Yield APY in 2025

As of mid-2025, the advertised APY (Annual Percentage Yield) is:

Up to 4.2% APY on USD balances

This is significantly higher than what traditional business checking or savings accounts offer (usually below 1%).

Airwallex Yield vs Traditional Business Accounts

| Feature | Airwallex Yield | Traditional Business Account |

|---|---|---|

| APY | Up to 4.2% | 0.01% – 1.00% |

| Withdrawal Restrictions | None | Often limited |

| Fees | No extra fees | Maintenance fees may apply |

| Liquidity | High (same-day access) | Limited in some cases |

Airwallex Yield offers superior returns with more flexibility.

Who is Airwallex Yield Best For?

- eCommerce businesses with large monthly volumes

- Startups and scaleups holding funds for runway or payroll

- Agencies and consultants managing client retainers

- SMEs looking to maximize idle cash without locking it away

- Global teams who want USD exposure with liquidity

Eligibility Requirements

- Must be a registered business with an active Airwallex USD account

- Available to businesses in selected jurisdictions (including U.S., U.K., Australia, Hong Kong, and Singapore)

- KYC/AML must be completed and up-to-date

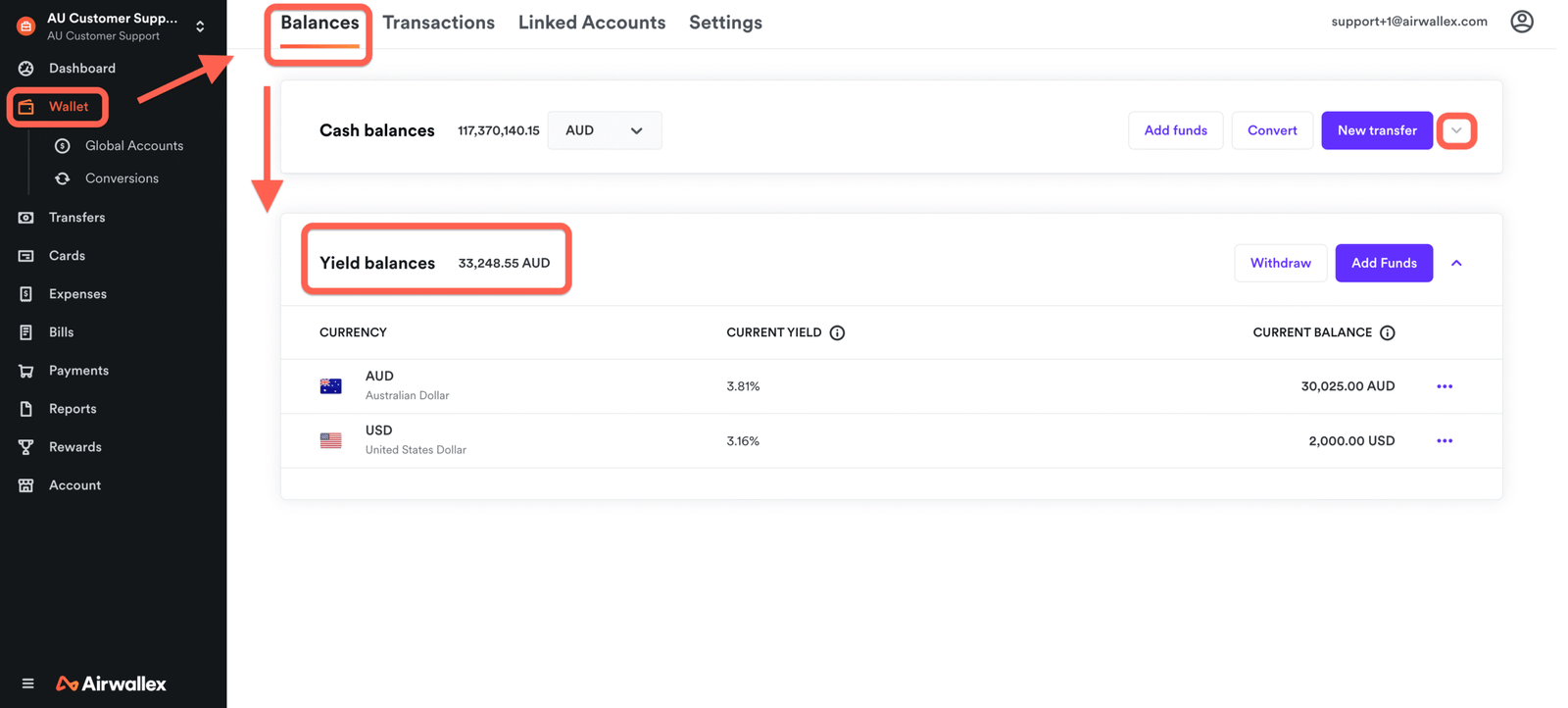

You’ll see the “Yield” tab or feature inside your Airwallex dashboard if your account is eligible.

How to Activate Airwallex Yield (Step-by-Step)

- Log in to your Airwallex dashboard

- Go to the “Yield” section

- Click on “Activate” and accept the terms

- Choose the amount of USD you want to earn interest on

- Sit back and start earning. Interest is calculated daily!

Is Airwallex Yield Safe?

Yes. Airwallex does not lend out or invest your funds in risky products.

Your money is stored with regulated U.S. financial institutions and governed by stringent compliance standards.

Key Safety Features:

- Custodied with U.S. financial partners

- Compliant with regulations in the U.S., U.K., Australia, Singapore, and Hong Kong

- Daily accruals and full visibility on your dashboard

- No hidden fees or lock-up periods

Tax Considerations

Any interest earned via Airwallex Yield is considered income for your business and may be subject to tax in your jurisdiction.

Always consult a qualified accountant or tax advisor to remain compliant.

READ ALSO: How To Maximize Your Last-Minute Tax Prep with QuickBooks

Airwallex Yield vs Competitor Business Interest Products

| Feature | Airwallex Yield | Wise | Mercury | Brex | Traditional Banks |

|---|---|---|---|---|---|

| Interest on Balances | Yes | No | Yes | Yes | Low or None |

| APY (2025) | Up to 4.2% | N/A | 5.00% | 4.68% | 0.01%–1.00% |

| Liquidity | Same-day | N/A | Daily | Daily | Delayed access |

| Withdrawal Restrictions | None | N/A | None | None | Often restricted |

Airwallex Yield offers a strong middle ground—high APY with full flexibility and deep integration into your financial stack.

Airwallex Pros and Cons

Pros:

- High yield on USD business balances

- No lock-up period; same-day access

- Daily interest calculation

- Easy to activate in-dashboard

- Fully regulated and transparent

Cons:

- Only supports USD balances

- Available in select countries

- Not insured under FDIC (as with most yield products)

In Summary: Should You Use Airwallex Yield?

If you're running a cash-positive business and already using Airwallex for your global financial operations, enabling Yield is a no-brainer.

It’s an easy way to earn a return on your idle USD funds while keeping them accessible for daily operations.

While not a replacement for investment or savings products, Airwallex Yield acts as a powerful tool for businesses who want a better alternative to zero-interest accounts.

In short: Get paid to hold your money, while staying liquid.

Frequently Asked Questions (FAQs)

What is the current Airwallex Yield interest rate?

Up to 4.2% APY on eligible USD balances as of 2025.

Can I withdraw my money anytime?

Yes. There is no lock-up period and you can access your funds at any time.

Is there a fee for using Yield?

No. Airwallex does not charge additional fees to enable or use Yield.

Can I earn interest in currencies other than USD?

Currently, Yield only supports USD balances.

Is my money insured?

Funds are held with regulated partners but are not FDIC insured like traditional U.S. banks. However, safety measures and transparency are in place.

Who is eligible for Yield?

Businesses with a verified Airwallex account in supported jurisdictions (U.S., U.K., Australia, Singapore, Hong Kong).

Want to make your money work smarter? Activate Airwallex Yield today and start earning interest on your business funds.

Ready to Level Up Your Business Skills?

Join my online school, Online Income Academy, for more expert guides, tutorials, and strategies to help you build a successful business. Sign up today!