This article is about Tailor Brands Business Registration in the USA. Yes; before you incorporate in America, its wise to weigh your options first to know which agency is the right one for you and your business type.

When it comes to business registration in America, Tailor Brands is a leader in the industry. So, yes, you can't go wrong with them, as far as we know.

Keep reading to see how to register your business in the US with Tailor Brands. No matter the type of business registration (LLC, C-Corp, S-Corp, Non-Profit) etc.

READ ALSO: Best LLC Formation Services and Agencies in the USA (Top Ranked)

Why Choosing the Right Business Structure Matters?

The entity type or structure you choose for business impacts:

- Legal liability: Your personal assets could be at risk if not appropriately protected.

- Tax obligations: Each structure has unique tax benefits and drawbacks.

- Funding opportunities: Some structures are more appealing to investors.

- Operational flexibility: Your ability to scale may depend on the structure.

Types of Business Registrations in the USA

Starting a business in the USA involves several critical steps, one of which is choosing the right type of business registration.

This decision influences your legal obligations, taxation, personal liability, and ability to raise capital.

Whether you're an entrepreneur launching your first venture or a small business owner looking to expand, understanding the various business registration types is essential.

1. Sole Proprietorship

A sole proprietorship is the simplest and most common type of business registration.

Key Features of Sole Proprietorship:

- Owned and operated by one individual.

- No legal distinction between the owner and the business.

- Easy and inexpensive to establish.

Pros:

- Complete control over business decisions.

- Minimal regulatory requirements.

- Simple tax filing as income is reported on personal tax returns.

Cons:

- Unlimited personal liability for debts and obligations.

- Limited ability to raise funds.

Business Example:

A freelance graphic designer working independently may opt for a sole proprietorship.

You can use a "doing business as" (DBA) name to create a professional brand identity while operating as a sole proprietor.

2. Partnership

A partnership type of business is an agreement between two or more individuals to share ownership of a business.

Types of Partnerships:

- General Partnership (GP): Equal sharing of profits, losses, and responsibilities.

- Limited Partnership (LP): Includes both general and limited partners.

- Limited Liability Partnership (LLP): Provides liability protection for all partners.

Pros:

- Shared responsibilities and resources.

- Easy to establish with minimal paperwork.

- Pass-through taxation benefits.

Cons:

- Potential for conflicts between partners.

- Shared liability for debts (except in LLPs).

Business Example:

Two chefs starting a catering business together may form a general partnership.

You can draft a detailed partnership agreement outlining roles, responsibilities, and conflict resolution mechanisms.

3. Limited Liability Company (LLC)

An LLC is a hybrid structure combining the benefits of a corporation and a partnership. This is one of the most popular type of business in the USA.

Key Features of an LLC:

- Owners (members) have limited personal liability.

- Flexible management structure.

- Taxed as a sole proprietorship, partnership, or corporation, depending on elections.

Pros:

- Limited liability protects personal assets.

- Pass-through taxation avoids double taxation.

- Suitable for small businesses and startups.

Cons:

- Higher registration and maintenance costs than sole proprietorships.

- State-specific regulations vary.

Business Example:

An e-commerce store owner selling handmade products may choose an LLC to protect personal assets.

You can use an online service like TailorBrands or consult an attorney to ensure your LLC formation complies with state laws.

4. Corporation

Corporations are separate legal entities from their owners. This type is usually for big businesses and also, LLC's can upgrade to this type of entity.

Types of Corporations:

- C Corporation: Subject to corporate taxes but allows unlimited shareholders.

- S Corporation: Offers pass-through taxation with restrictions on the number of shareholders.

Pros:

- Limited liability for shareholders.

- Easier to raise capital through stock issuance.

- Perpetual existence regardless of ownership changes.

Cons:

- Complex formation process.

- Double taxation for C Corporations.

- Extensive record-keeping and regulatory requirements.

Business Example:

A tech startup seeking venture capital may form a C Corporation to attract investors.

You can file the necessary documents with your state’s Secretary of State office and issue stock certificates to shareholders.

5. Nonprofit Organization

Nonprofits are formed to serve public or charitable purposes.

Key Features:

- Eligible for tax-exempt status under IRS Section 501(c)(3).

- Profits must be reinvested into the organization.

Pros:

- Tax exemptions and deductions for donors.

- Access to grants and funding.

Cons:

- Strict compliance and reporting requirements.

- Limited ability to distribute profits to members.

Example Type:

A community food bank may register as a nonprofit to support its mission of combating hunger.

You can hire a professional to navigate the IRS 501(c)(3) application process for tax-exempt status.

6. Cooperative

A cooperative is a business owned and operated by its members for mutual benefit.

Key Features of a Cooperative:

- Members share profits and decision-making responsibilities.

- Common in industries like agriculture, retail, and housing.

Pros:

- Member-driven decision-making.

- Limited liability for members.

Cons:

- Challenging to secure external funding.

- Slower decision-making processes.

Example Type:

A group of farmers forming a cooperative to market their produce collectively.

With this type, you need to develop a clear member agreement to define rights, roles, and profit-sharing terms.

READ ALSO: Best Affiliate Marketing Software

How to Register a Business in the USA

This is a step-by-step guide on how to register a business in the US from anywhere in the world using the Tailor Brands business registration agency.

You can form an LLC, register a C-Corp business type, register an S-Corp business type, or even a Non-Profit Company.

All you need to do is follow my step-by-step guide and you will be done in no time.

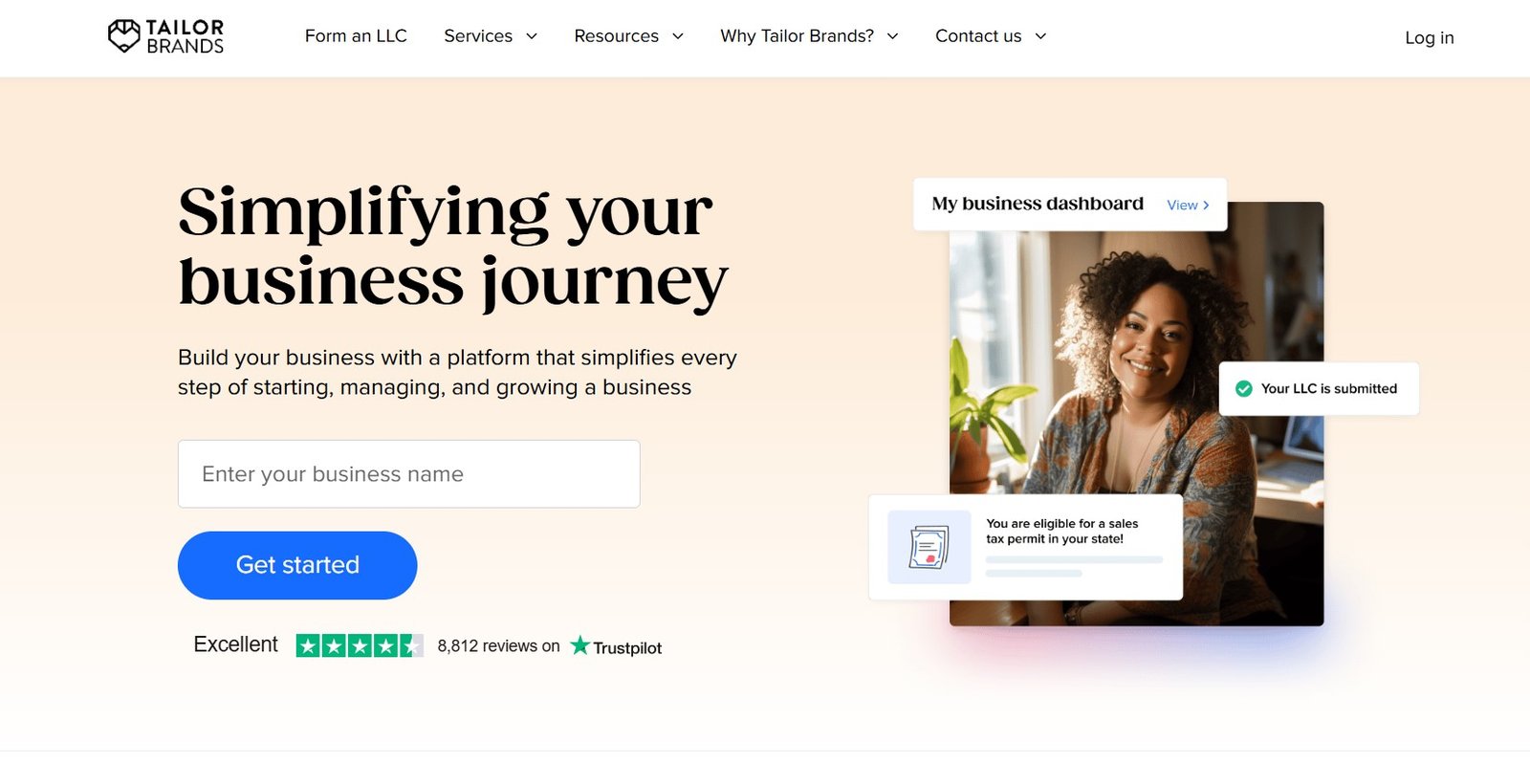

Step 1. Visit www.tailorbrands.com and enter the business name you wish to register in the box as shown in the image below.

Once you are done with that, you will redirected to the registration portal where you'll be required to enter a few details about your business.

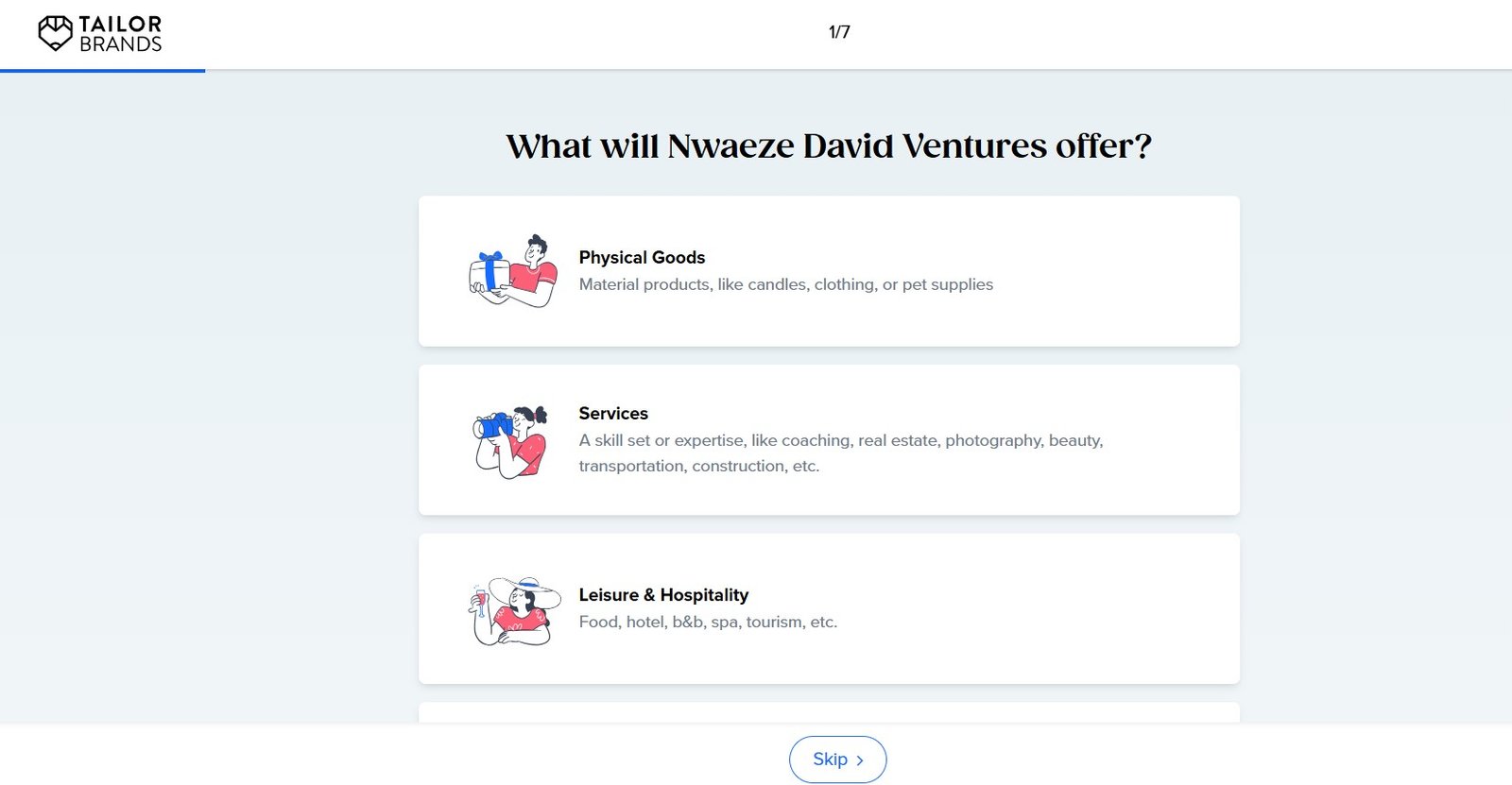

Next, select what type of goods/service your business offer. If it's digital like mine, then scroll down and select the digital option.

If you don't want to answer the question, there's a skip button below each step.

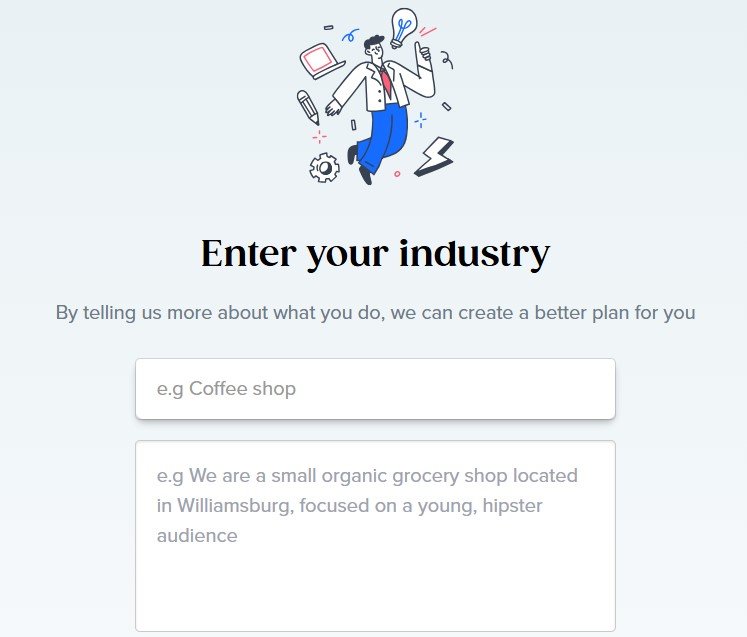

Step 2: Select Your Business Industry.

As you can see from the image above, enter what your business do in the required box. This will help the software understand your business and setup a more suitable business registration for you.

If you are already up and running, select it, if now select from the provided options.

Step 3: Select LLC Formation.

You can actually select more that one option here, but the main thing you need to select is the LLC formation option.

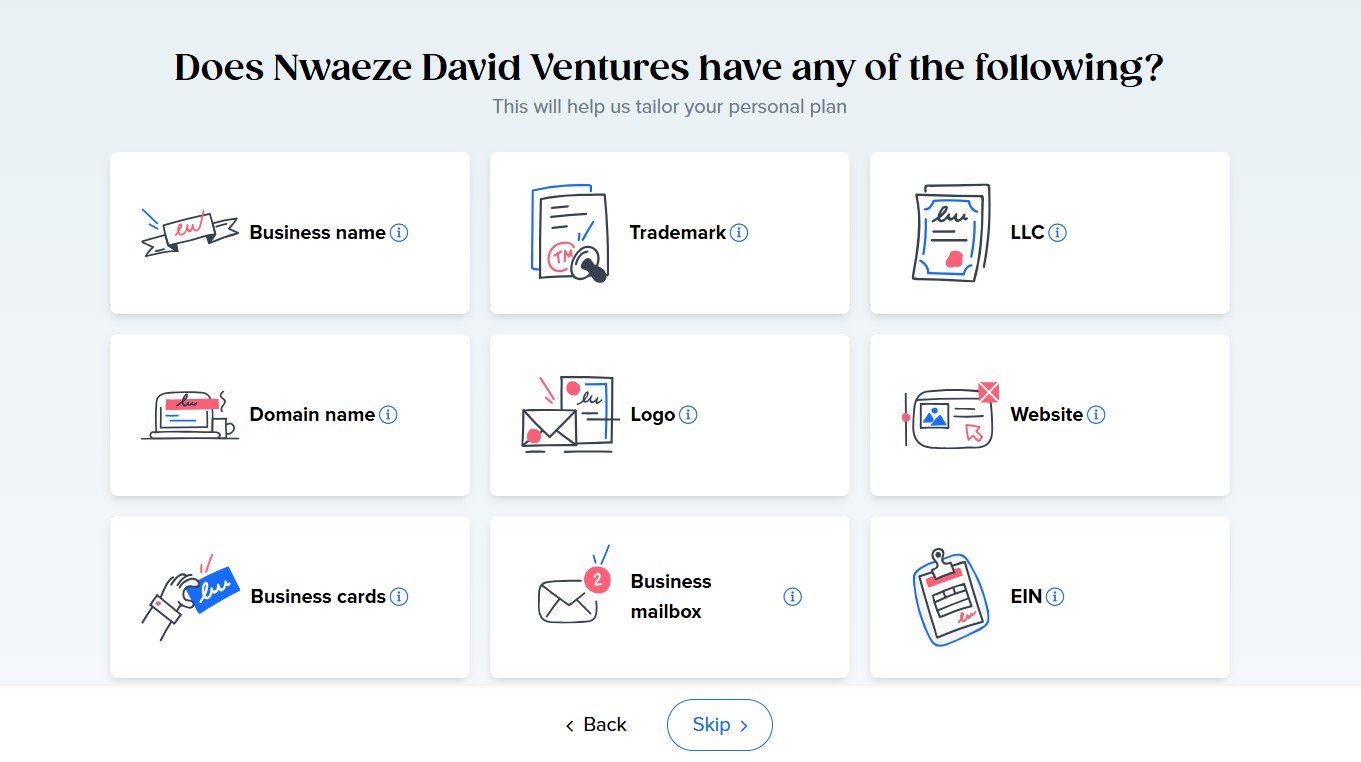

Select all the options you already have right now. If you don't have any of these, then skip this step and everything will be included in your package.

Select other and continue. If you are asked to explain, simply enter 'nwaezedavid.com' in the option and continue.

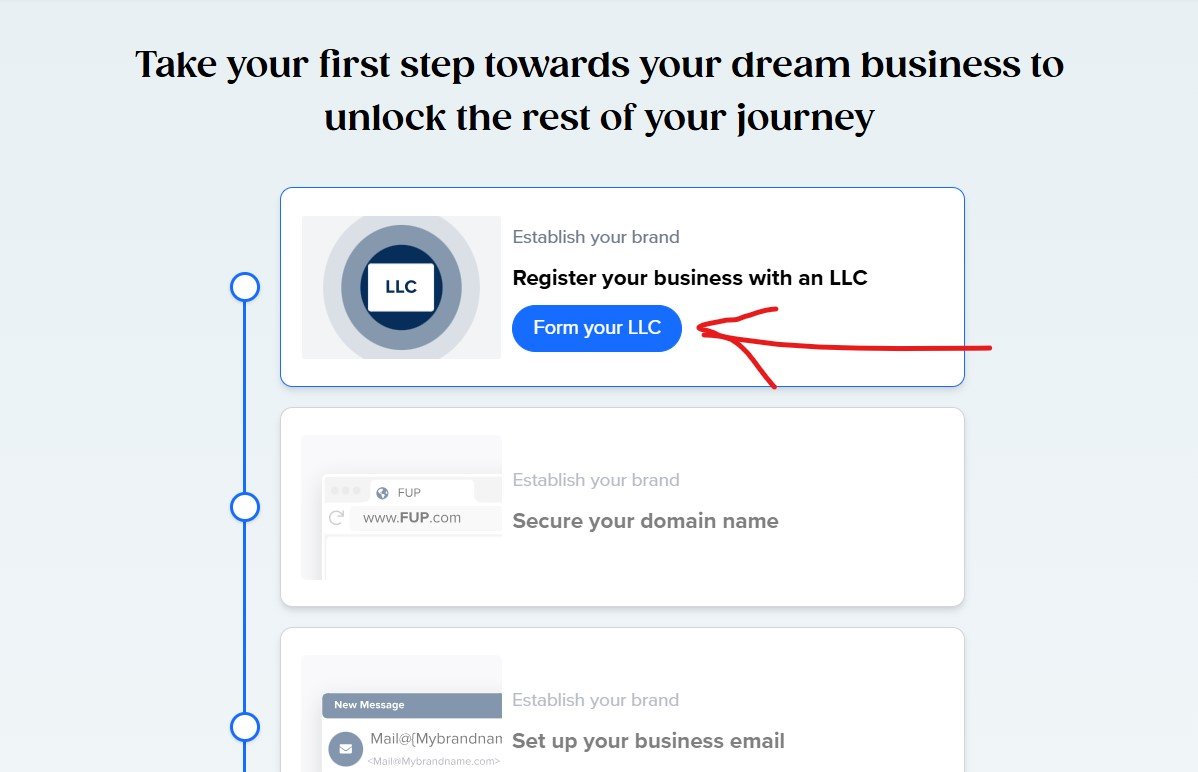

Step 4: Register your business with an LLC.

Click on the 'Form your LLC' button as shown in the image.

Enter your name and email address to create your account.

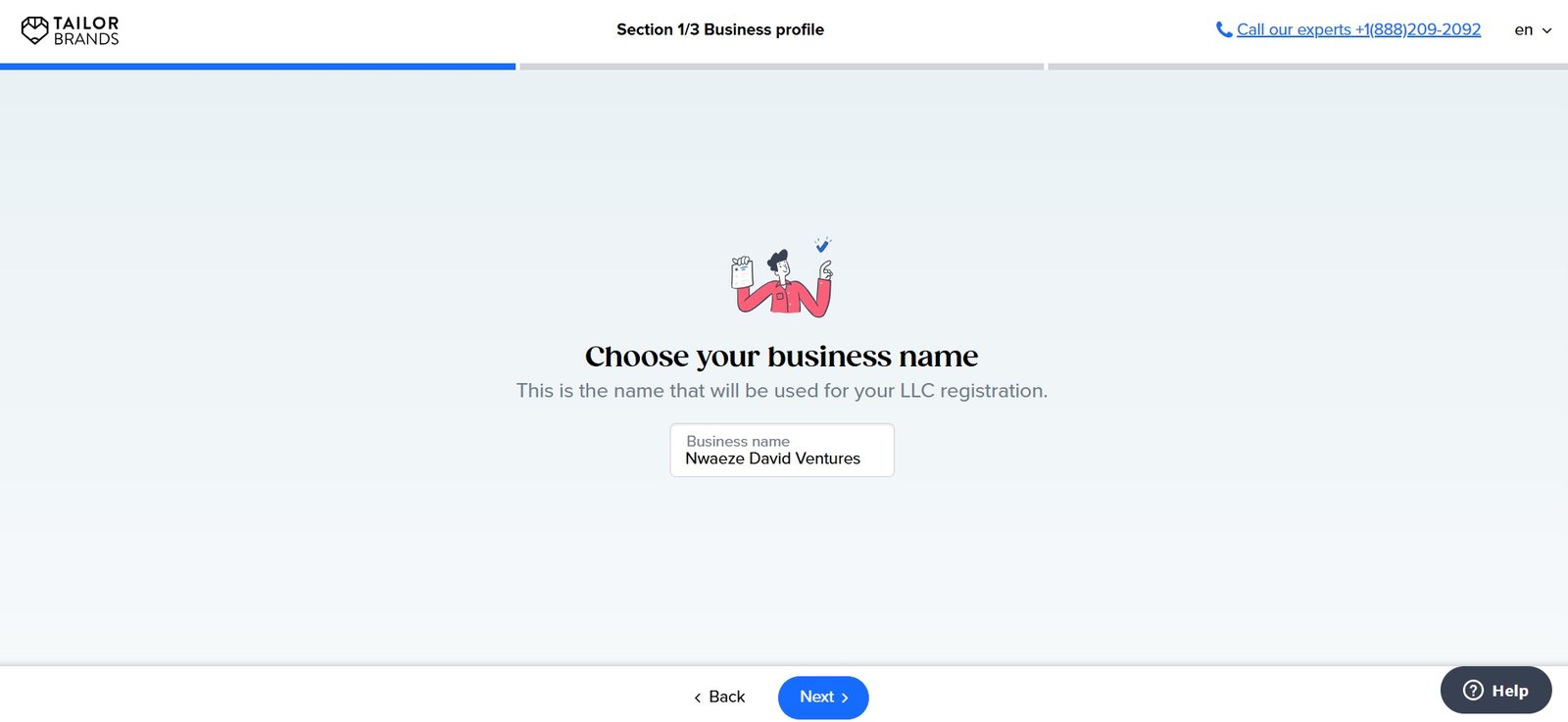

Step 5: Choose Your Business Name.

If the name you entered before wasn't available, you will be notified at this step and them be required to change the name. However, if the name is available, it will look like the image above; all you have to do is click on Next.

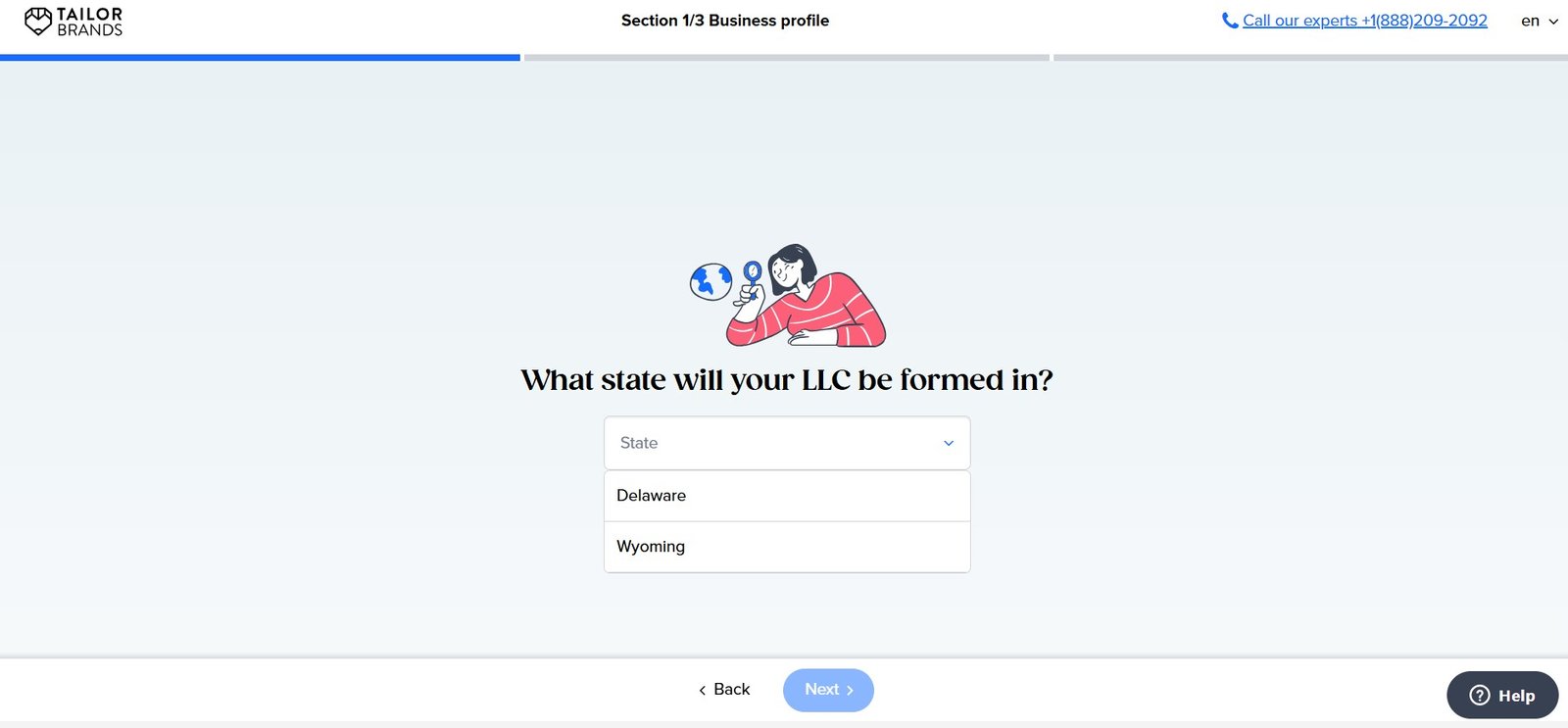

Step 6: Select the state where your LLC will be formed in.

There are only two option here; Delaware or Wyoming. I will recommend you select Wyoming because it is tax friendly friendly and less expensive.

It's free, so go ahead and select it.

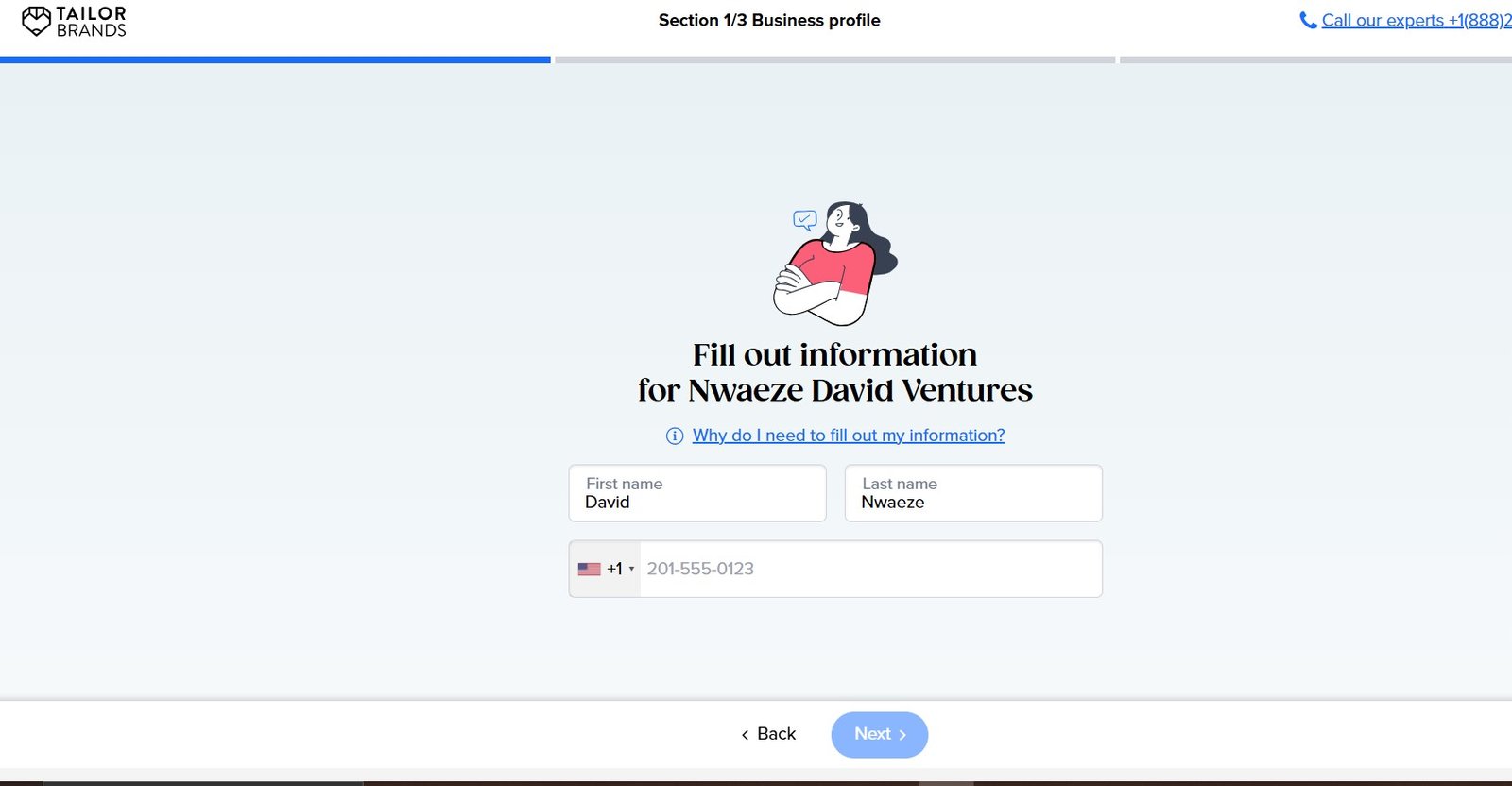

Step 7: Enter your name and phone number.

To get a USA phone number, visit any of these websites:

This is mostly to help create your account and process your registration.

Step 8: Select the EIN option.

An EIN (Employer Identification Number) is a 9-digit federal business tax ID issued by the IRS. It’s required for U.S. business taxes.

To get one, you need to file Form SS-4 with the IRS, and we can help with that.

- It’s essential for non-U.S. citizens looking to open a U.S. business bank account, establish business credit, and apply for loans.

- An EIN allows you to manage your U.S. business without needing to provide your personal identification, such as a passport or foreign tax ID.

- Most U.S. banks require an EIN to open a business bank account for non-U.S. citizens.

What's the Process for Non-U.S. Citizens?

Non-U.S. citizens must fill out Form SS-4 to apply for an EIN. You will receive a filled ss4 document from us.

The IRS requires non-U.S. citizens to email or fax the form directly to them. We will provide you with the instructions. The process typically takes 4-6 weeks for the IRS to issue the EIN once they receive your application.`

Step 9: Select a Registered Agent for your Business.

A registered agent is a designated individual or business entity that must be available during business hours to handle formal documents for your business.

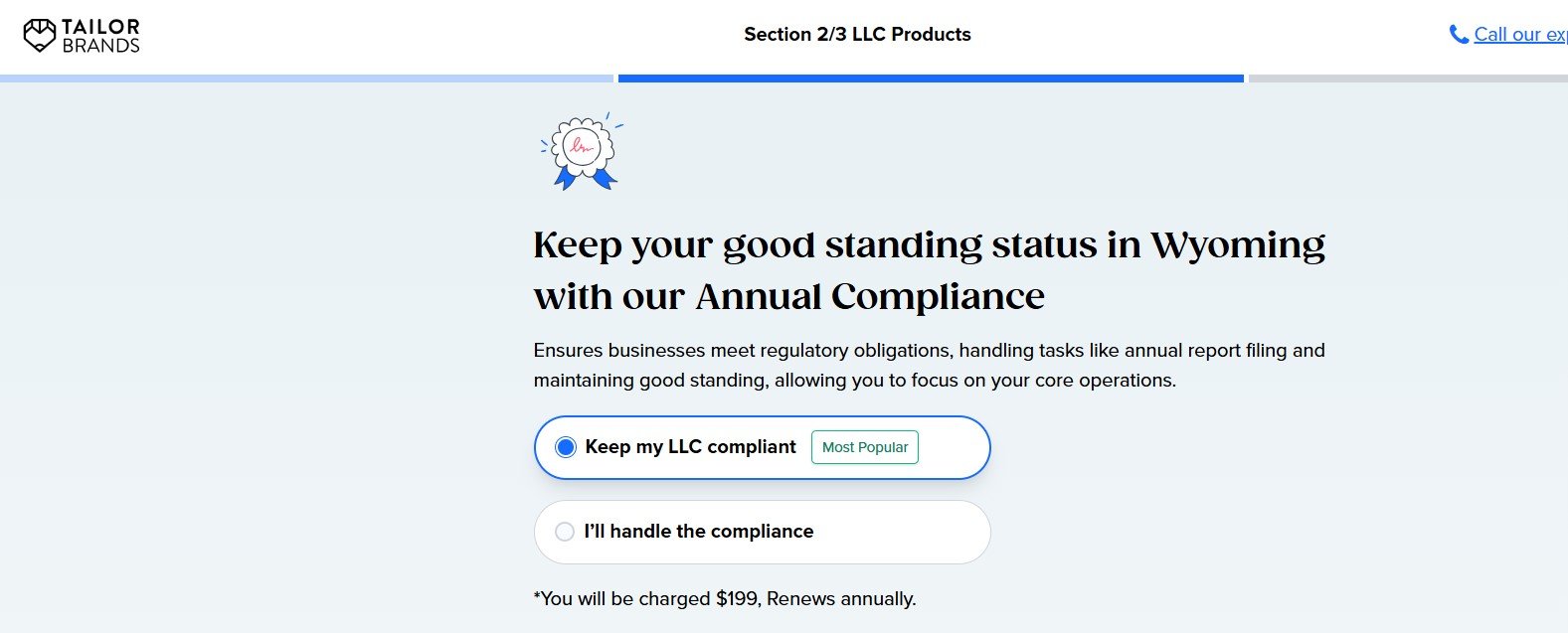

I recommend you select Tailor Brands to do this for you. This will help you control cost and also run everything from one dashboard.

If you have a legal system in place to handle all the compliance for you, then you can skip this. However, if you don't have one, I recommend you select the option shown in the image above to keep your LLC compliant.

This is optional, so if you want it, go ahead and select it, if you don't then select 'I don't want the tools' and continue.

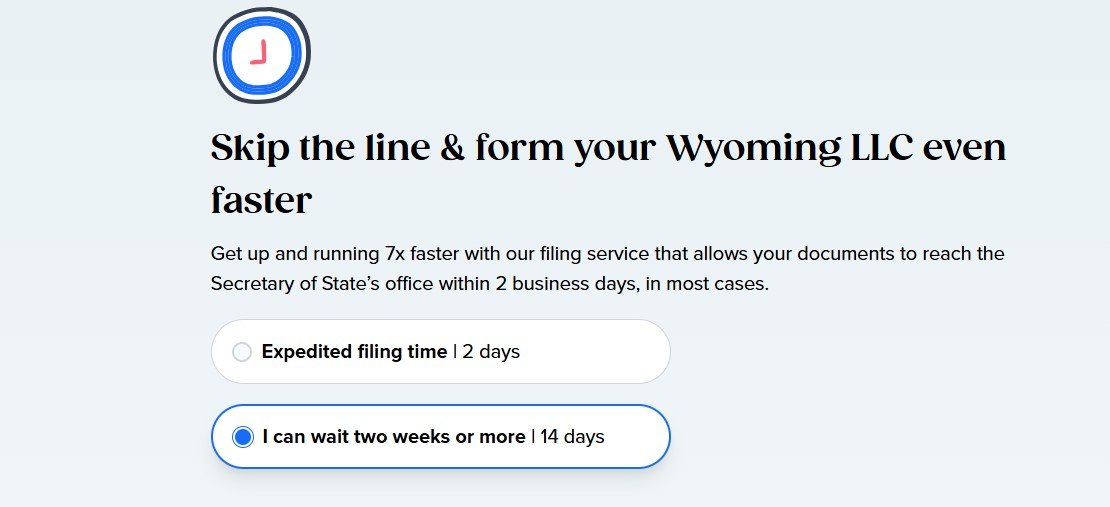

If you want the filling to be done faster, then select the Expedited filling time and everything will be done in 2 days.

This will cost you about $49; however this is optional so if you don't want it, you can skip it and it will take 14 days.

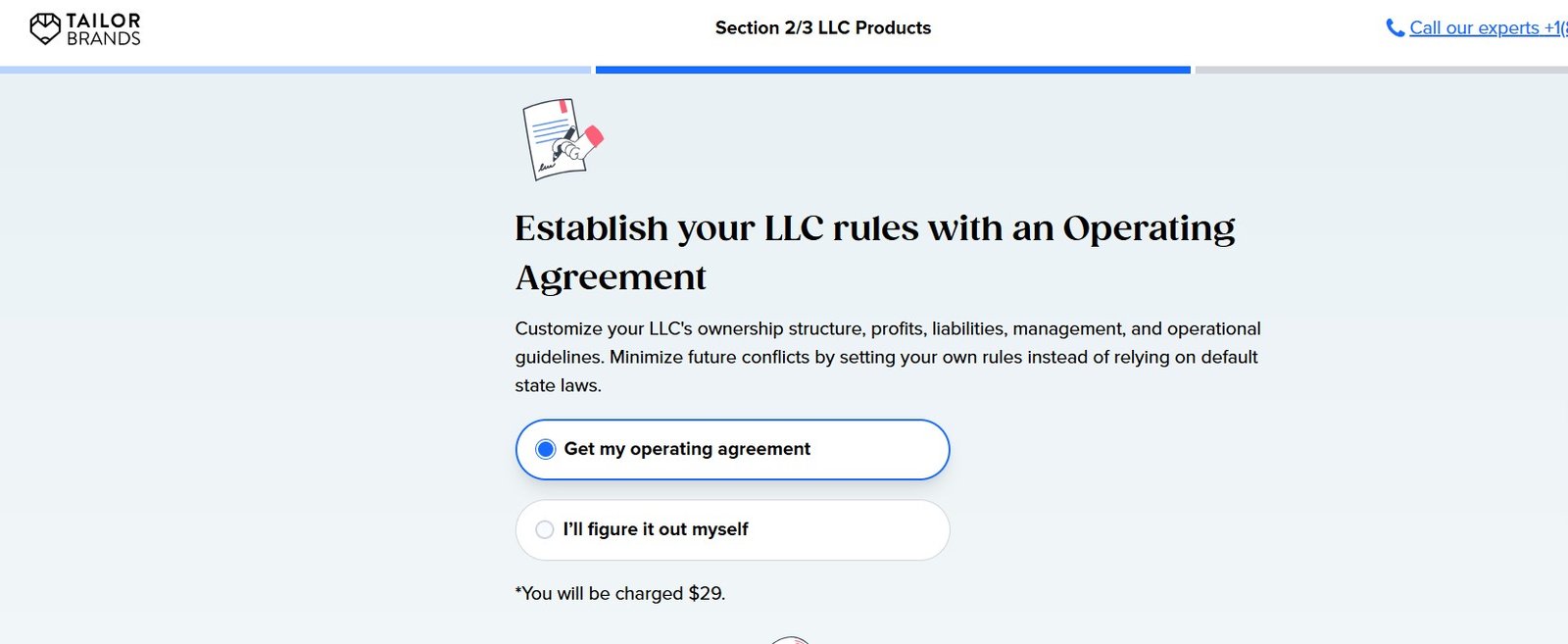

Step 10: Select Operating Agreement documents.

This document will help you minimize future conflicts by setting your own rules instead of relying on default state laws.

Customize your LLC's ownership structure, profits, liabilities, management, and operating guidelines.

It's an important document so you should have it.

This option is FREE, so yes go ahead and select it.

READ ALSO: Airwallex Business Account Review (Features, Fees and Alternatives)

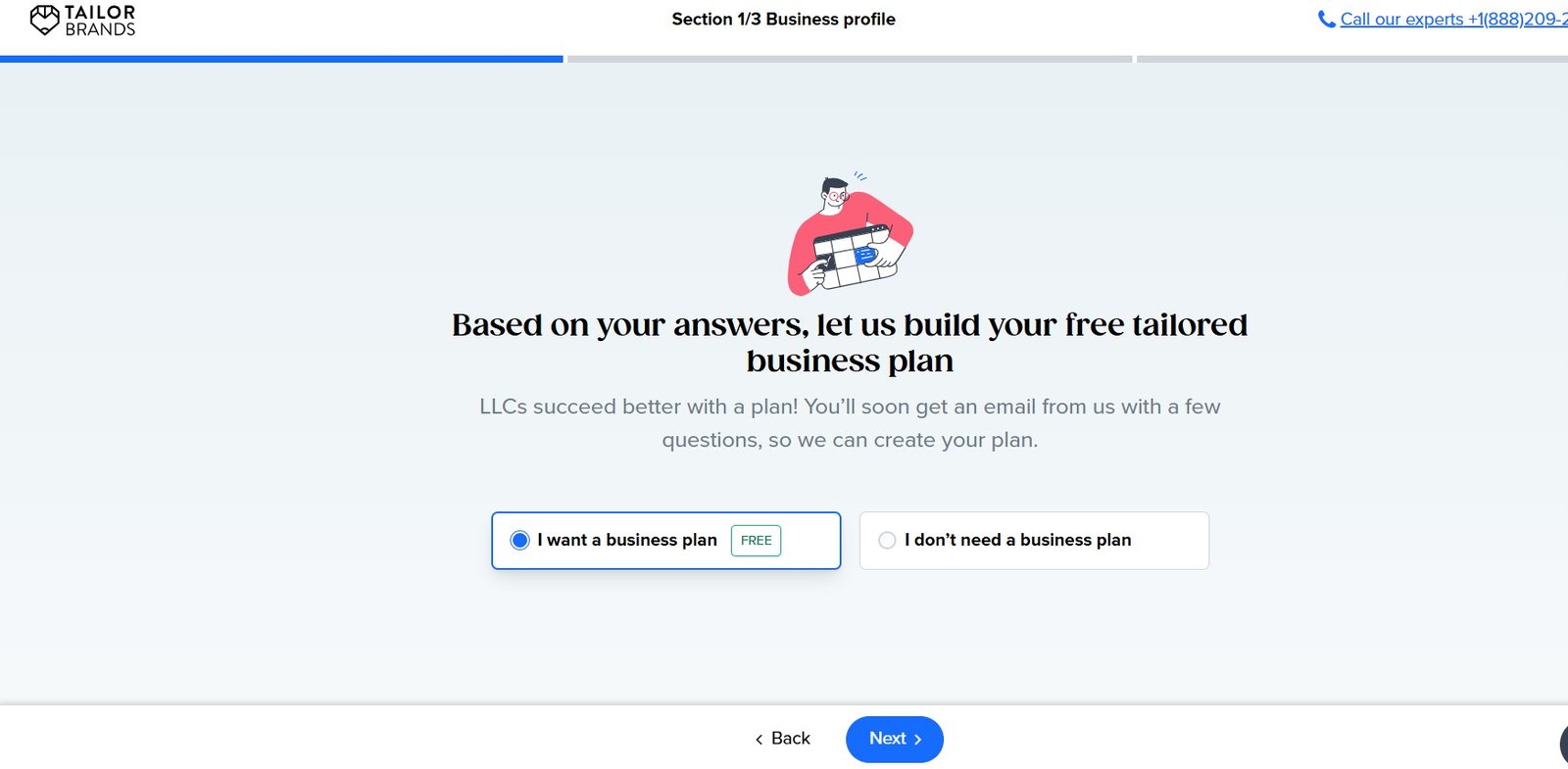

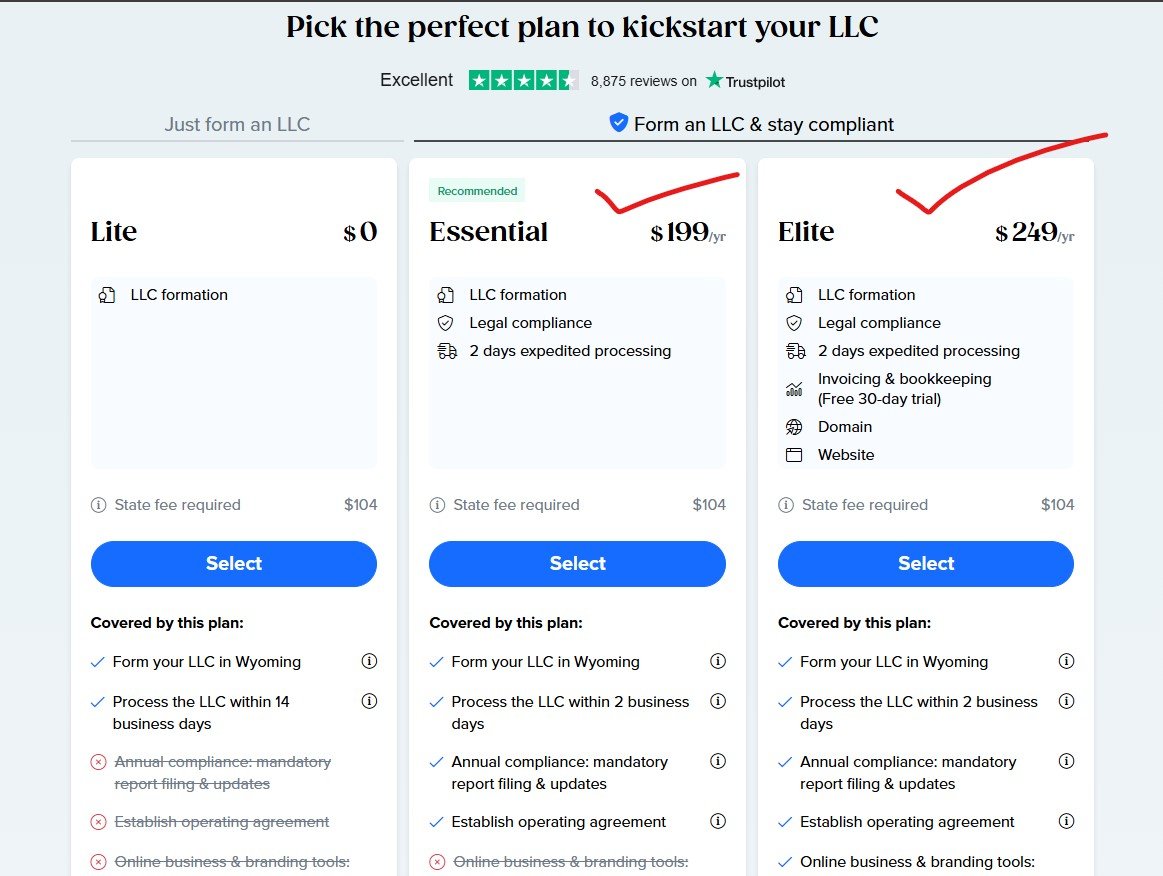

Step 11: Select a Business Registration Plan.

Select either the Essential Plan or the Elite Plan. Those are the plans that will legally register your business will all the necessary documentation, such as EIN, etc.

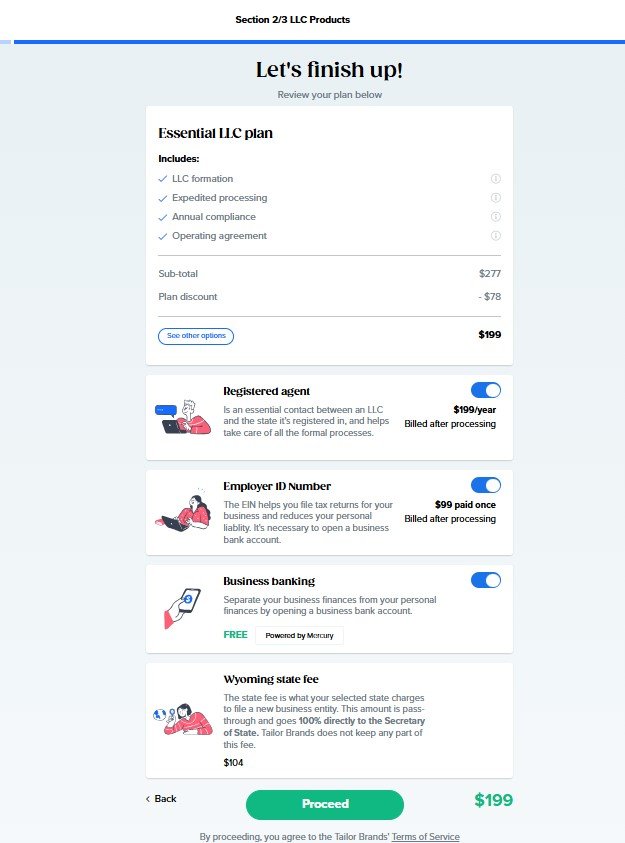

Step 12: Review and Make Payment.

Select the payment option you like and make payment. You can do that with either PayPal or with Credit/Debit card.

Enter your payment details and complete your payment. Once this is done, your business registration will commence.

Congratulations! You just registered your business in the USA.

READ ALSO: UK Business Formation/Registration Guide

FAQs about Tailor Brand Business Registration in the USA

A sole proprietorship is the easiest and least expensive to establish, making it ideal for solo entrepreneurs.

Yes, many businesses start as sole proprietorships or partnerships and later transition to LLCs or corporations as they grow.

No you don't.

However, while its not mandatory, consulting an attorney can ensure compliance with state and federal regulations.

Yes you can.

If you follow through the steps in this article, you will be able to do just that.

Yes, forming an LLC always includes a state filing fee, which can vary depending on the state, but it's part of the official formation process.

Absolutely, operating an LLC does require following state rules and guidelines which can include regular filings and fees, in order to maintain good standing of your business.

If you don't maintain LLC compliance, you may face serious financial penalties, and even risk the state dissolving your LLC.

Typically, forming an LLC could take anywhere from a few days to a couple of weeks depending on how busy the state office is.

In most cases, Tailor Brands expedited filing service can get your paperwork to the state within 2 business days.

Tailor Brands Alternatives

Founded in 2014, Bizee has Registered over 1,000,000 Businesses in the US.

One of the things I love about Bizee is the fact that they make is easy and possible for anyone from any location in the world to register their business in the USA.

BetterLegal has a reputation for being fast when it comes to business registrations and company filing; Your company will be official in just 2 business days.

Unlike Bizee and ZenBusiness, you’ll have to pay for “Registered Agent Service” which is priced at $10/month or $90/year. But, every other thing is pretty much covered.

ZenBusiness is a unique business registration service provider in the US that is popular for its simplicity.

They make the process look easy and simple. All you have to do is fill out a form and they will handle everything.

When it comes to pricing, they are one of the most affordable options and also very fast business fillings.

NorthWest Registered Agent is a family-owned business with the best customer service when compared with other business registration services.

Founded in the year 1998, they have what I call super-familiar experience when it comes to business registrations in the US.

Firstbase.io was founded in 2019 and has helped over 10,000 founders in the United States to incorporate their business in the US.

Firstbase is what you can call an all-in-one Company OS that helps define how founders across the globe launch, manage and grow their businesses.

Business Anywhere is somewhat of an All-in-One Business Solution system which is super nice and important for young entrepreneurs that have zero experience.

You can easily get everything you need for your business all in one place and that will make business management to be easy and flexible.

Just like all other mentioned business registration agencies in this article, Business Anywhere is perfect for non-us citizens to form an LLC in the US.

In Summary

When it comes to business registration in the USA, everyone in the world have a chance to do business in America, thanks to Tailor Brands and other agencies.

As you proceed, choosing the right type of business registration is a foundational step in building a successful business.

By understanding the pros and cons of each structure and aligning them with your goals, you can set your business on the path to growth and sustainability.

Don’t hesitate to seek professional advice to navigate this critical decision.

- Research your state’s specific registration requirements.

- Draft a business plan to guide your structure choice.

- Consult with a business advisor or attorney.

Ready to Level Up Your Business Skills?

Join my online school, Online Income Academy, for more expert guides, tutorials, and strategies to help you build a successful business. Sign up today!