Let's discuss accounting software for businesses; as you already know, if you run a Limited Company in the UK, you know the drill: HMRC does not accept excuses.

With the final rollout of Making Tax Digital (MTD) fully enforced, the days of handing your accountant a shoebox of receipts or a messy Excel file are over.

In 2026, you need software that connects directly to HMRC’s servers to submit your VAT returns digitally.

But with dozens of options promising to "simplify your life," which one actually works for a UK business?

I have tested the 5 top-rated accounting platforms available in the UK right now. I looked at how they handle UK VAT schemes, PAYE payroll integration, and multi-currency banking (for those selling abroad).

Whether you are a one-person contractor or running a digital agency, one of these 5 is the right fit.

READ ALSO: How To Maximize Your Last-Minute Tax Prep with QuickBooks

We’re reader-supported. When you buy through links on our site, we may earn an affiliate commission.

Top 5 Ranked Accounting Software

(For those in a rush, here are the winners by category)

| Rank | Software | Best For... | Starting Price (UK) |

| #1 | Xero | Best Overall. The industry standard for Ltd companies. | £16/mo |

| #2 | QuickBooks | Best for VAT. Handles complex inventory & VAT schemes best. | £14/mo |

| #3 | FreeAgent | Best Value. (Often FREE if you bank with NatWest/Mettle). | £19/mo* |

| #4 | Sage | Best for Traditionalists. Loved by older school accountants. | £14/mo |

| #5 | FreshBooks | Best for Freelancers. Easiest invoicing for service businesses. | £12/mo |

Note: All the 5 software options listed here are HMRC Recognized for Making Tax Digital (MTD) for VAT.

1. Xero: The UK's "Gold Standard"

My Rating:

If you ask 10 modern UK accountants what software they recommend, 9 of them will say Xero. It has effectively replaced Sage as the default choice for small to medium-sized enterprises (SMEs) in the UK.

Why it wins for Ltd Companies:

UK Bank Integration: It connects flawlessly with virtually every UK bank (Monzo, Starling, Barclays, HSBC, Revolut). The feeds rarely break.

Payroll: Unlike its US version, the UK version of Xero has a robust built-in Payroll module that handles auto-enrolment pensions (Nest, The People's Pension, etc.) and files RTI submissions to HMRC automatically.

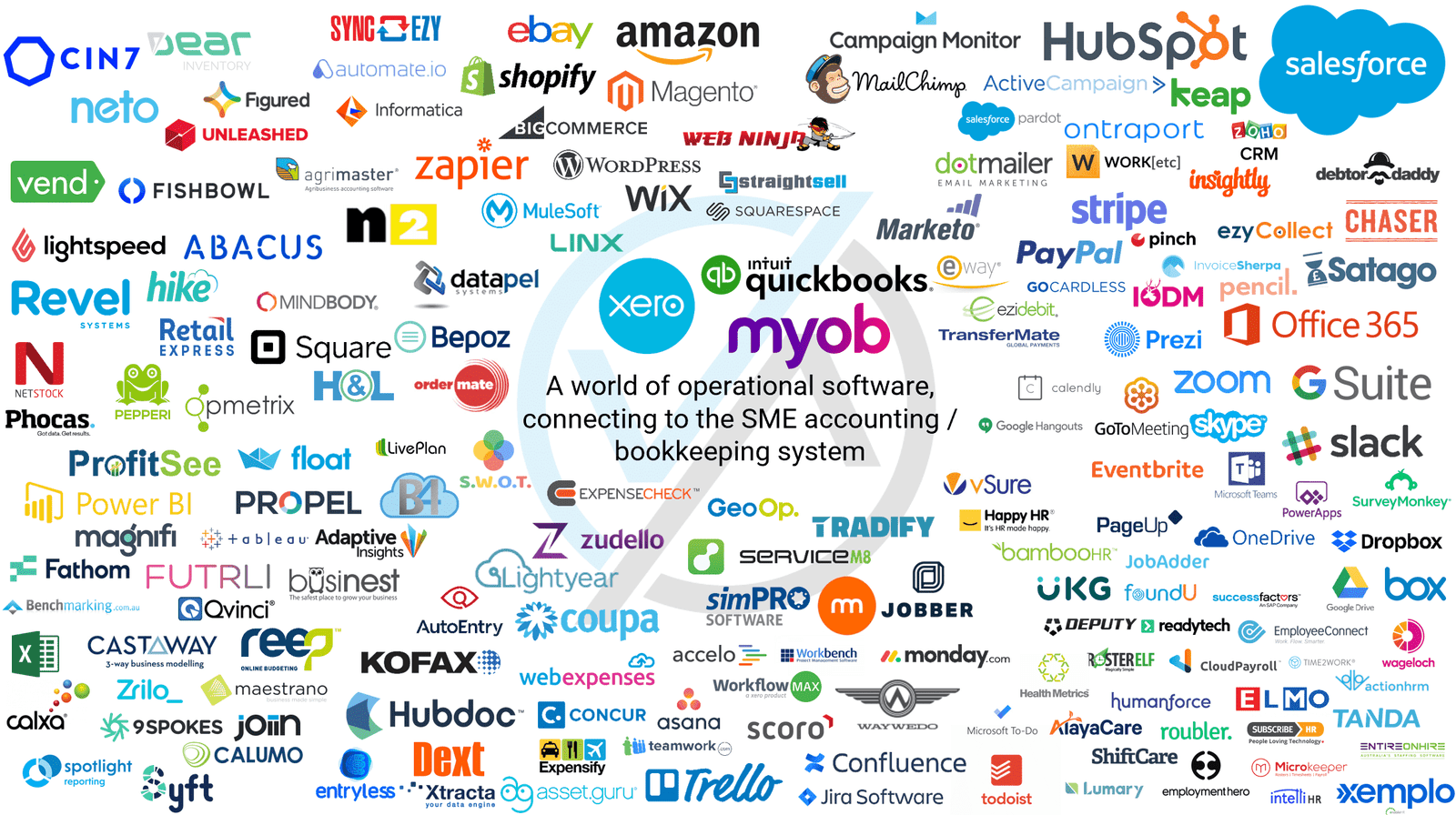

The Ecosystem: It integrates with Dext (for receipts), Shopify, and GoCardless (for Direct Debits).

The Downside: It is not the cheapest. To get "Multi-Currency" (essential if you bill clients in USD or Euros), you must be on the "Comprehensive" plan (£47/mo+), which is steeper than competitors.

2. QuickBooks Online: The Inventory Powerhouse

My Rating:

While Xero is the "cool kid," QuickBooks is the heavy lifter. If your Limited Company sells physical goods (e-commerce) or you are on a complex VAT scheme (like the Flat Rate Scheme or Margin Scheme), QuickBooks often handles the math better.

Why it wins:

Reporting: The reporting tools are deeper and more customizable than Xero's.

Inventory: It has better native stock management features before you need to buy expensive add-ons.

Price: They often run aggressive discounts (e.g., "50% off for 6 months"), making it cheaper to start than Xero.

The Downside: The user interface feels a bit cluttered compared to Xero. Also, unlike Xero, they charge you extra for adding additional users, which can get expensive if your team grows.

3. FreeAgent: The "Hidden Gem" (Best Value)

My Rating:

This is the industry's best-kept secret. FreeAgent was acquired by the NatWest Group, and they made a bold move: They give the software away for free if you have a business bank account with specific banks.

Why it wins:

The Price Tag (Free): If your Limited Company banks with NatWest, Royal Bank of Scotland (RBS), or Mettle, you get a full FreeAgent license for £0. This saves you roughly £300+ per year.

Built for Contractors: If you are an IT contractor or a freelancer operating as a Limited Company (IR35), FreeAgent is designed specifically for you. It handles the "Self Assessment" tax return for directors better than Xero.

The Downside: It is quite simple. If your business grows to 10+ employees or you start holding complex stock, FreeAgent will feel too basic. It lacks the massive "App Store" ecosystem that Xero has.

4. Sage Accounting: The "Old Faithful"

My Rating:

Sage is the grandfather of UK accounting. If your accountant is over 50 or you are dealing with a very traditional firm, they will likely ask you to use Sage.

Why it wins:

Compliance: Sage is practically synonymous with HMRC compliance. It is incredibly robust for VAT and audit trails.

Support: Their UK-based phone support is excellent (something Xero lacks).

The Downside: The interface feels like it is stuck in 2010. It is not as "fun" or intuitive to use as Xero or QuickBooks. It feels like work.

5. FreshBooks: Best for Service-Based Solopreneurs

My Rating:

If your Limited Company sells time, not products (e.g., consultants, designers, copywriters), FreshBooks is a strong contender. It started as an invoicing tool and evolved into accounting software.

Why it wins:

Invoicing: It has the most beautiful invoices of the bunch.

Time Tracking: It has a built-in time tracker that automatically converts your hours into an invoice.

Ease of Use: It is arguably even easier to learn than Xero.

The Downside: It is weak on "pure" accounting features. If you need to produce a complex Balance Sheet for a bank loan, or if you hire staff and need payroll, FreshBooks struggles compared to Xero.

What UK Limited Companies Must Know in 2026

Before you buy any of these software, you need to understand the two legal requirements that dictate your software choice in the UK.

1. MTD (Making Tax Digital) is Non-Negotiable

Since 2022, all VAT-registered businesses must keep digital records and submit VAT returns using compatible software. You cannot use the old HMRC website login anymore.

The Rule: If you pick software that isn't on the HMRC approved list (like a random Excel template), you risk fines.

Good News: All 5 options listed above are fully MTD-compliant.

2. Payroll & RTI (Real Time Information)

As a Limited Company director, you likely pay yourself a small salary + dividends. This means you are an "employee" of your own company.

The Requirement: You must submit payroll data to HMRC on or before payday (RTI).

The Choice:

Xero: Has a built-in payroll module (UK version only) that is excellent.

QuickBooks: Also has built-in payroll.

FreshBooks: Requires a 3rd party integration.

In Summary: Which One Should You Choose?

- Choose FreeAgent IF: You bank with NatWest, RBS, or Mettle. The software is solid, and you can't beat "free."

- Choose QuickBooks IF: You sell physical products (inventory) or are on a complex VAT margin scheme.

- Choose Xero IF: You want the best all-rounder. It has the best bank feeds, the best app ecosystem, and it scales with you from a 1-person company to a 50-person agency.

FAQs about Account Software for UK Limited Companies

1. Is it a legal requirement to use accounting software for a Limited Company?

Technically, no, but practically, yes. Under Making Tax Digital (MTD), all VAT-registered businesses must use compatible software to submit VAT returns.

You cannot log into the HMRC website and type in the numbers manually anymore. While you could technically use spreadsheets and buy "bridging software" to submit the data, it is often more hassle than just using Xero or QuickBooks.

2. Can I still use Excel if I don't want to pay for software?

You can, but it is risky. If you use Excel, you must use "Bridging Software" to digitally link your spreadsheet to HMRC's system for VAT.

However, from April 2026/2027, Companies House is moving to a "Software-Only" filing system for annual accounts, effectively killing off paper and manual web filing.

It is safer to switch to cloud software now.

3. Which is the cheapest accounting software for a UK Limited Company?

If you want a "known" brand, FreshBooks or QuickBooks (on a discount) are often the cheapest entry points.

However, the absolute best value is FreeAgent, which is 100% free if you open a business bank account with NatWest, Royal Bank of Scotland (RBS), or Mettle.

4. I already have an accountant. Do I still need to buy this software?

Yes. In the past, you gave your accountant a box of receipts once a year. Today, you and your accountant should access the same software.

You do the daily invoicing and banking (the "bookkeeping"), and your accountant logs in to do the complex tax returns and adjustments.

Most accountants will actually require you to have Xero or QuickBooks before they take you on as a client.

5. Does Xero or QuickBooks file my Corporation Tax Return (CT600)?

This is a common confusion. Most accounting software handles VAT and Payroll perfectly. However, filing the final Company Tax Return (CT600) usually requires an accountant or "Final Accounts" production software.

Note: Xero and FreeAgent do have a feature to file simple micro-entity accounts directly to Companies House/HMRC, but for most standard companies, your accountant will extract the data from Xero and file the return using their own specialist software.

6. Can I switch from QuickBooks to Xero (or vice versa) mid-year?

Yes, but it is best to do it at your "Year End." Switching in the middle of a financial year can get messy with opening balances and duplicate transactions.

If you must switch mid-year, use a migration service (like Movemybooks, which is often free for moving to Xero) to ensure your historical data is transferred correctly.

7. Is Sage still relevant in 2026?

Sage is still a giant, but it is largely used by larger, traditional firms or manufacturing businesses with complex needs.

For 90% of modern digital/service small businesses, Xero or QuickBooks Online are faster, easier to use, and have better mobile apps.

Ready to Level Up Your Business Skills?

Join my premium youtube online community, for more expert guides, tutorials, and strategies to help you build a successful business. Sign up today!