Without wasting any of your precious time, I am going to show you how to convert Naira to Dollars online from the comfort of your home.

By now, you've already seen how the naira is struggling against the dollar. With this information, you too can have dollars in your name and also benefit whenever the value goes up.

This article will show you how to convert naira to dollars in Nigeria; you can also convert naira to pounds or even convert naira to euro. The best part is that you can do all these online from home.

So, let's get to it, shall we?

How to Convert Naira to Dollars Online (Step-by-Step)

Step 1. Open a Domiciliary Account Online

I have already covered how to open a domiciliary account online in Nigeria from the comfort of your home, but I'll still touch on a few things on that here again.

If you already have a grey account, then go ahead and proceed to step 4. But if you haven't, then follow me step by step in this post.

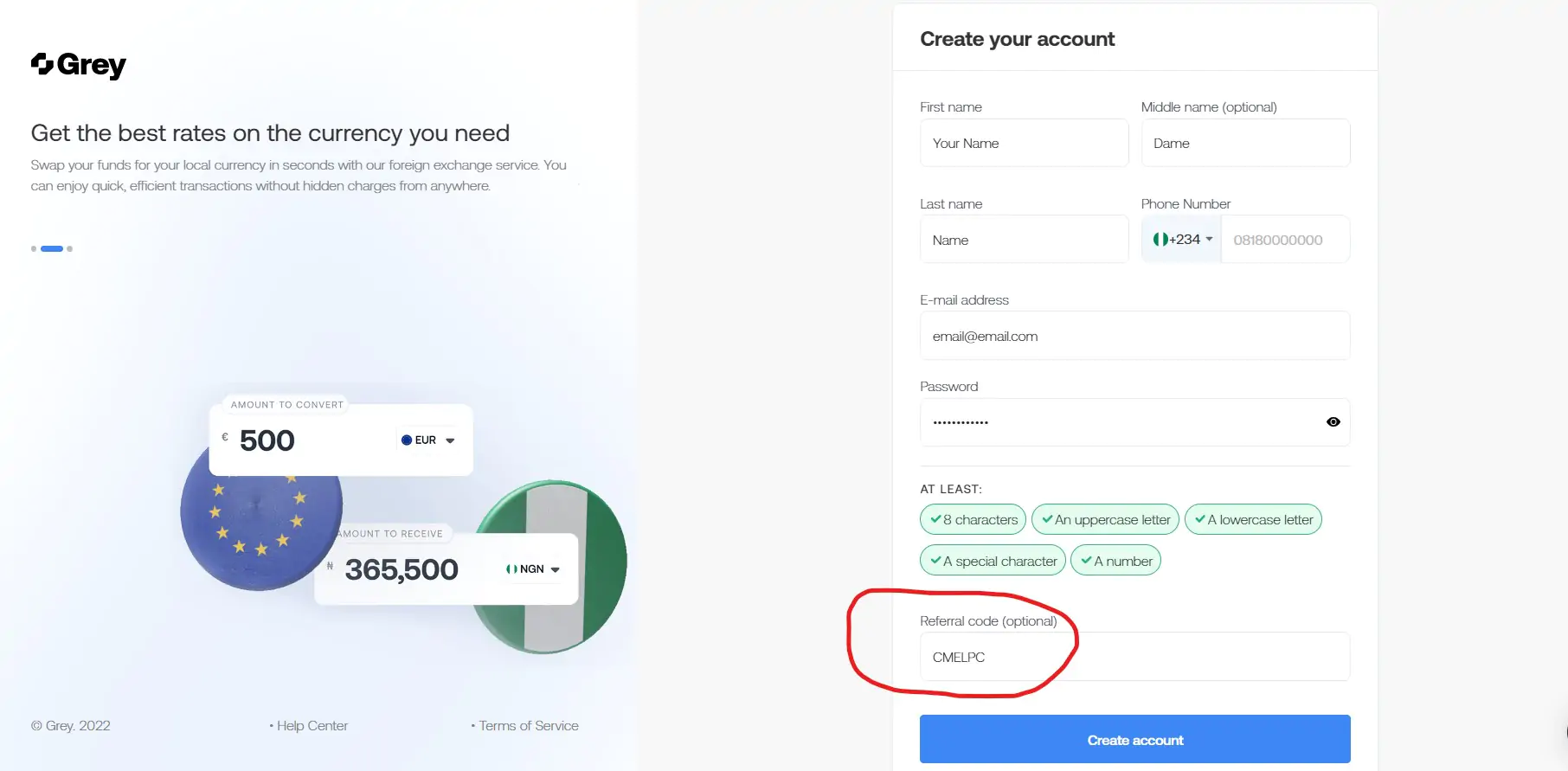

Visit grey.co and click on create account.

Enter all your info and make sure that your email and phone number are correct. Also, make sure that your name matches the one on your ID card because you will need to verify your identity with an ID card.

NOTE: In the Referral code box; copy this: CMELPC and paste it in there.

This is my referral code, and if you use it, Grey will give me a little bonus for showing you how to do this. So, feel free to appreciate me by using that code. Thanks!!

Step 2. Account Verification Process

Now that you have created an account, it’s time to verify your identity. Don’t worry, this process is simple and you should be done in no time.

Just like every other bank, you’ll need to verify your Identity. So, submit the requested ID confirmation on your dashboard and wait for them to review it.

Once it is approved, you can now request a dollar account.

Step 3. Domiciliary Account Request

Once your account is approved, you can now request a dollar bank account, a Euro bank account, a pound bank account, and also a Naira bank account.

NOTE: Your naira bank account is what you are going to use to deposit your naira, then convert it to dollars which is now deposited into your dollar account.

You can also do the same thing for other currencies.

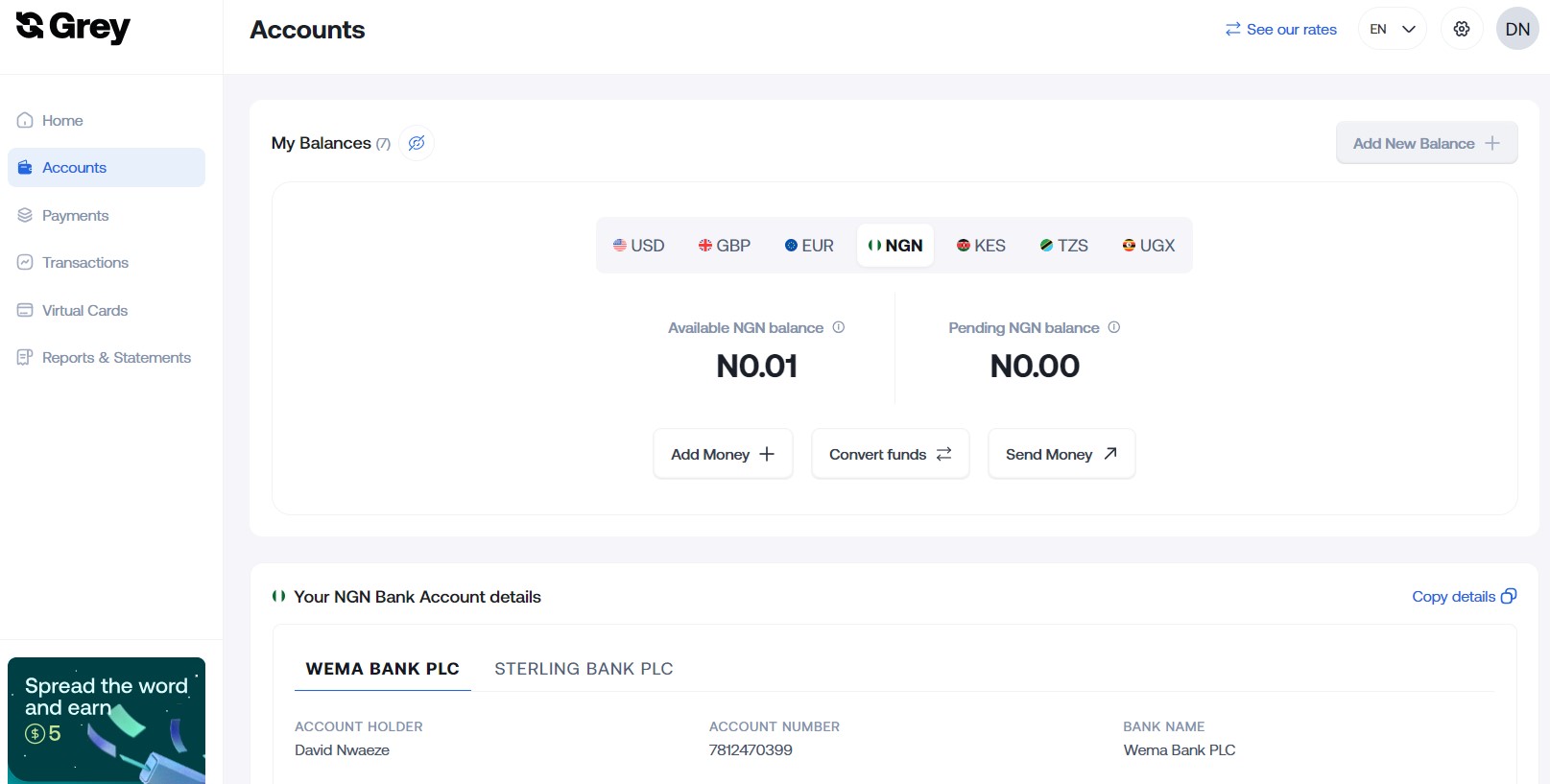

As you can see in the image above, I’ve already gotten mine. All you need to do as a new user is click on the request button. They will use the information you submitted for verification to create a foreign account for you.

With these accounts, you will be able to send and receive payments internationally.

Step 4. Fund Your Naira Account

When requesting foreign bank accounts, there’s an option to also request a local bank account, such a as Nigerian Bank account, Ghana, etc.

Make a request for the local bank account and your account will be created for you, then you can fund the account by making a normal bank transfer to the new account in your local currency.

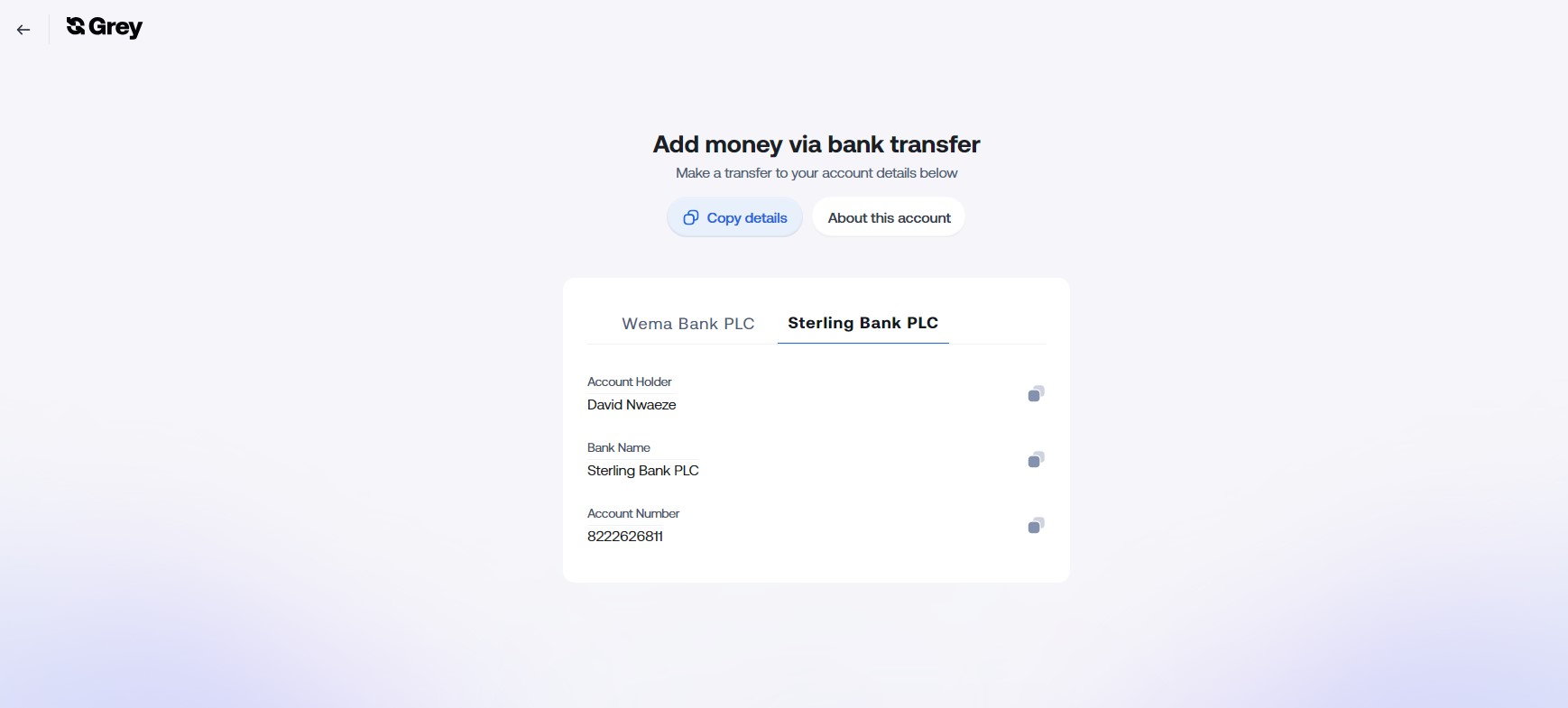

As you can see in the image below, two (2) naira accounts will be created for you by Wema Bank and Sterling Bank. These accounts will automatically receive any money sent to them and it will reflect on your grey account immediately.

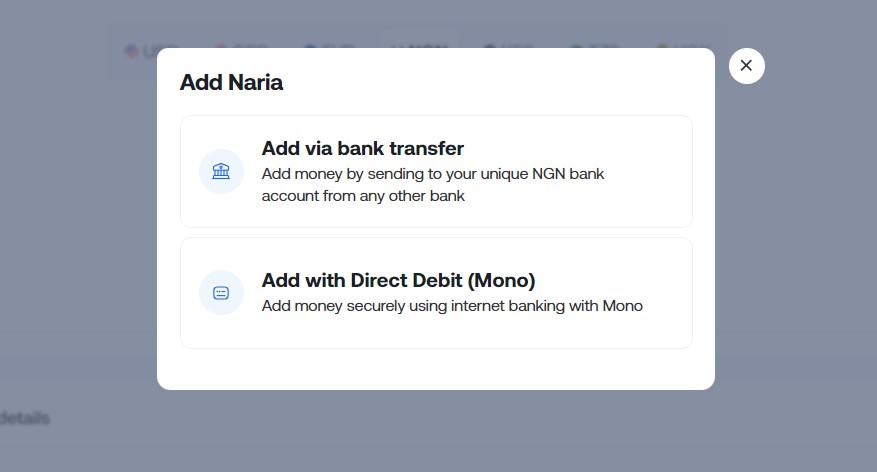

Click on Add Money.

There are two options when it comes to funding the account, the first and easiest is to make a transfer to the local bank account created for you. The deposit will show up on your grey wallet instantly.

Or, you can link your banking app to Grey and make the deposit automatically through the Grey app.

Select the deposit option that is most convenient for you and then make the transfer. Your money will reflect immediately on your grey account.

If you selected the Add via bank transfer, then your bank accounts will show up on the screen.

You can choose between your Wema Bank account or your Sterling Bank account. Make the transfer and proceed to the next step.

Step 5. Convert Your Naira to Dollars

At this point, I want to congratulate you for successfully creating a domiciliary account online in Nigeria from the comfort of your home. Now, it's time to use these accounts for good and make money online by saving money or by arbitrage.

If you are new to the arbitrage business, then you are going to be wowed by this.

Now, let's convert the naira we just deposited into dollars or any other foreign currency of choice.

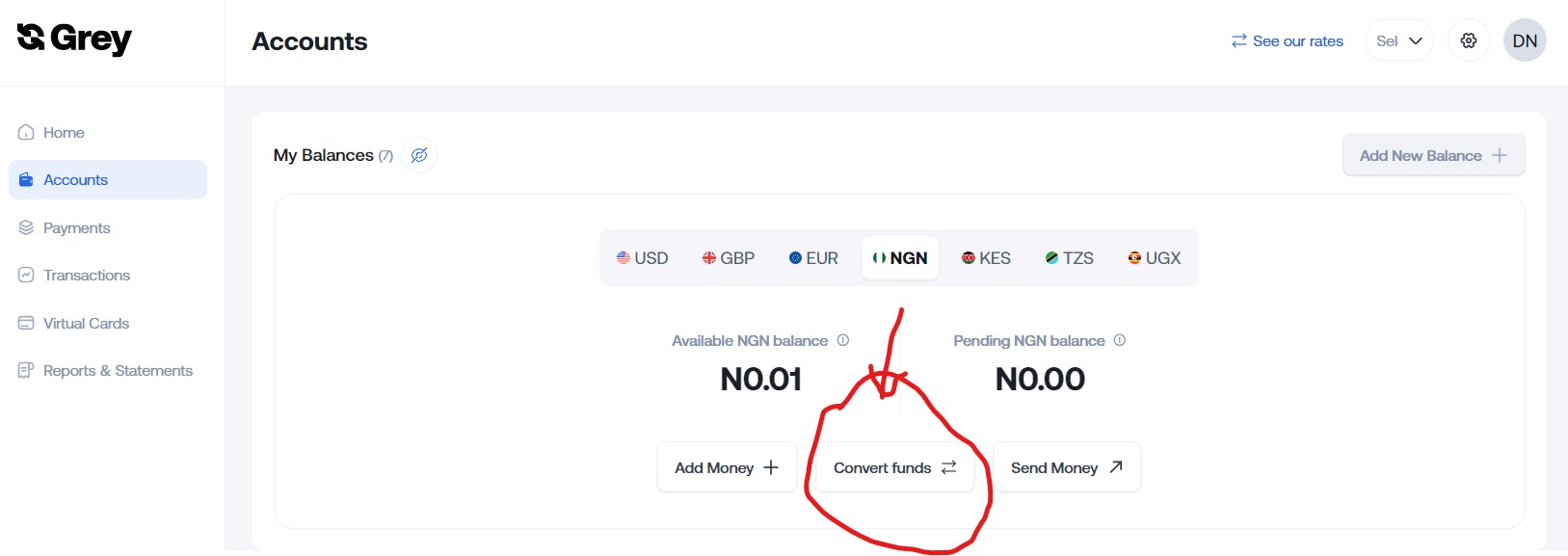

From your menu, go to Accounts and select the NGN option.

Click on Convert funds as shown in the image above.

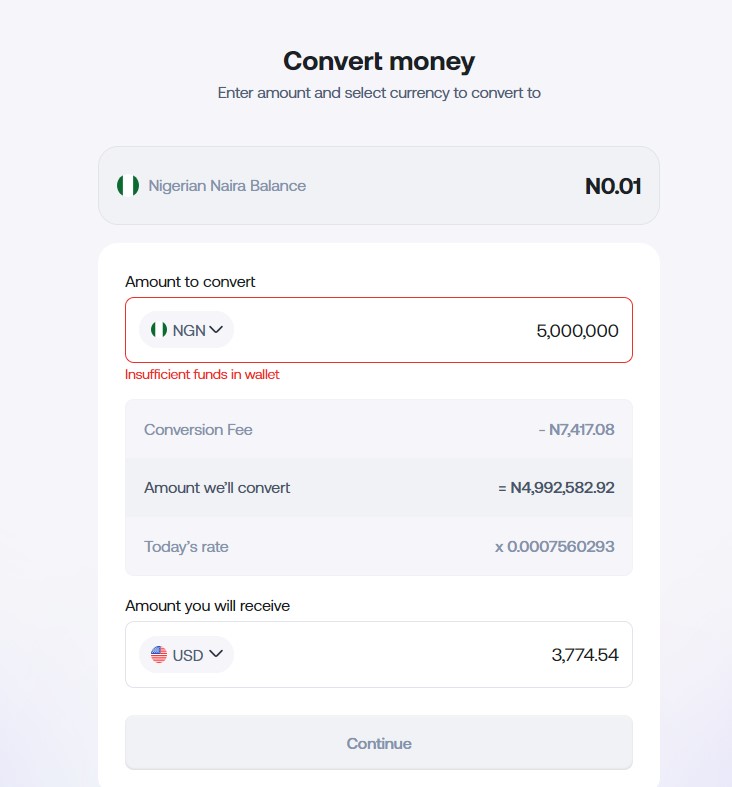

The first currency column is your naira and then, the second currency column is dollars or any other currency you wish to convert your naira to.

As you can see in the image above, we are converting #5,000,000.oo to dollars and we're receiving $3,774.54 in return.

What is Arbitrage Business?

Savvy investors have long recognized the potential of currency arbitrage as a lucrative opportunity.

Arbitrage, at its core, involves exploiting the price differences of a financial instrument across different markets, allowing traders to capitalize on these discrepancies and generate risk-free profits and that is what you just did.

Currency arbitrage, in particular, has gained immense popularity in recent years as the foreign exchange (forex) market has become increasingly interconnected and volatile.

By leveraging the fluctuations in exchange rates between different currencies, traders can execute a series of simultaneous transactions to lock in a profit, without assuming any significant market risk.

The Mechanics of Currency Arbitrage

The essence of currency arbitrage lies in identifying and capitalizing on the temporary mispricing of currencies across various exchange platforms. This can occur due to a variety of factors, such as:

- Market Inefficiencies: Disparities in the supply and demand of currencies can lead to discrepancies in the exchange rates offered by different brokers, banks, or exchanges.

- Geopolitical Factors: Events such as political instability, economic policy changes, or global trade dynamics can cause sudden shifts in currency values, creating arbitrage opportunities.

- Technological Advancements: The rise of high-frequency trading and sophisticated algorithmic strategies has enabled traders to identify and exploit price differences more efficiently than ever before.

The mechanics of currency arbitrage typically involve the following steps:

- Identify Price Discrepancies: Traders continuously monitor exchange rates across multiple markets, looking for any significant gaps or mispricing between the buy and sell prices of a particular currency pair.

- Execute Simultaneous Trades: Once a suitable opportunity is identified, the trader will simultaneously execute buy and sell orders for the same currency pair, but at different exchange rates, locking in the price difference.

- Capture the Spread: The trader then immediately closes the positions, capturing the profit margin, or "spread," between the two exchange rates.

It's important to note that successful currency arbitrage requires precise timing, excellent market knowledge, and the ability to execute trades rapidly, as these price discrepancies are often short-lived.

READ ALSO: How to Streamline Your Business Finances with QuickBooks Online

The Benefits and Challenges of Currency Arbitrage

Currency arbitrage offers a range of benefits for savvy traders, including:

- Risk-Free Profits: By design, currency arbitrage strategies involve no market exposure, as the simultaneous buy and sell orders cancel out any underlying market risk.

- Consistent Returns: When executed effectively, currency arbitrage can generate consistent, albeit modest, profits, providing a reliable income stream for traders.

- Liquidity and Accessibility: The forex market is the largest and most liquid financial market in the world, offering ample opportunities for currency arbitrage across a wide range of currency pairs.

However, currency arbitrage is not without its challenges:

- Narrow Profit Margins: The competitive nature of the forex market means that price discrepancies are often quickly identified and exploited, resulting in increasingly narrow profit margins.

- High-Speed Execution: Traders must be able to execute trades with lightning-fast speed to capitalize on these fleeting opportunities, requiring sophisticated trading infrastructure and algorithms.

- Regulatory Oversight: Regulatory bodies closely monitor the forex market for potential manipulation or abusive trading practices, which can limit the scope of certain arbitrage strategies.

Despite these challenges, currency arbitrage remains a popular strategy among financial professionals, hedge funds, and individual traders who are willing to adapt to the dynamic nature of the forex market.

READ ALSO: How to Start a Blog & Make Money Online ($250k Per Month)

Summary

There you have it, a detailed guide on how to convert naira to dollars online in Nigeria from the comfort of your home. I believe i covered everything, but if you have any questions, please ask.

Currency arbitrage continues to offer a unique opportunity for traders to generate risk-free profits by capitalizing on temporary price discrepancies in the foreign exchange market.

As technology advances and market conditions evolve, the practice of currency arbitrage will likely continue to evolve, attracting a new generation of savvy investors seeking to leverage the power of global currency movements.