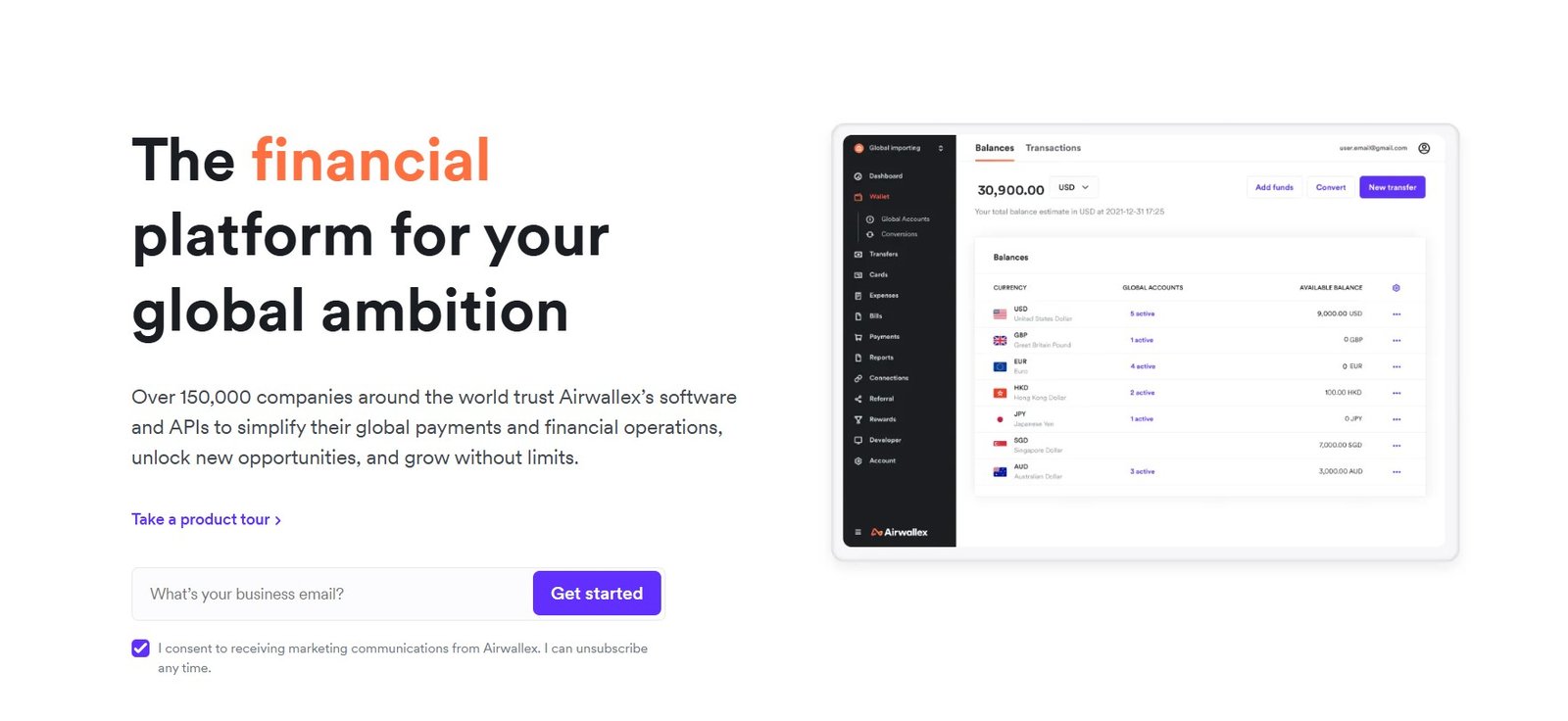

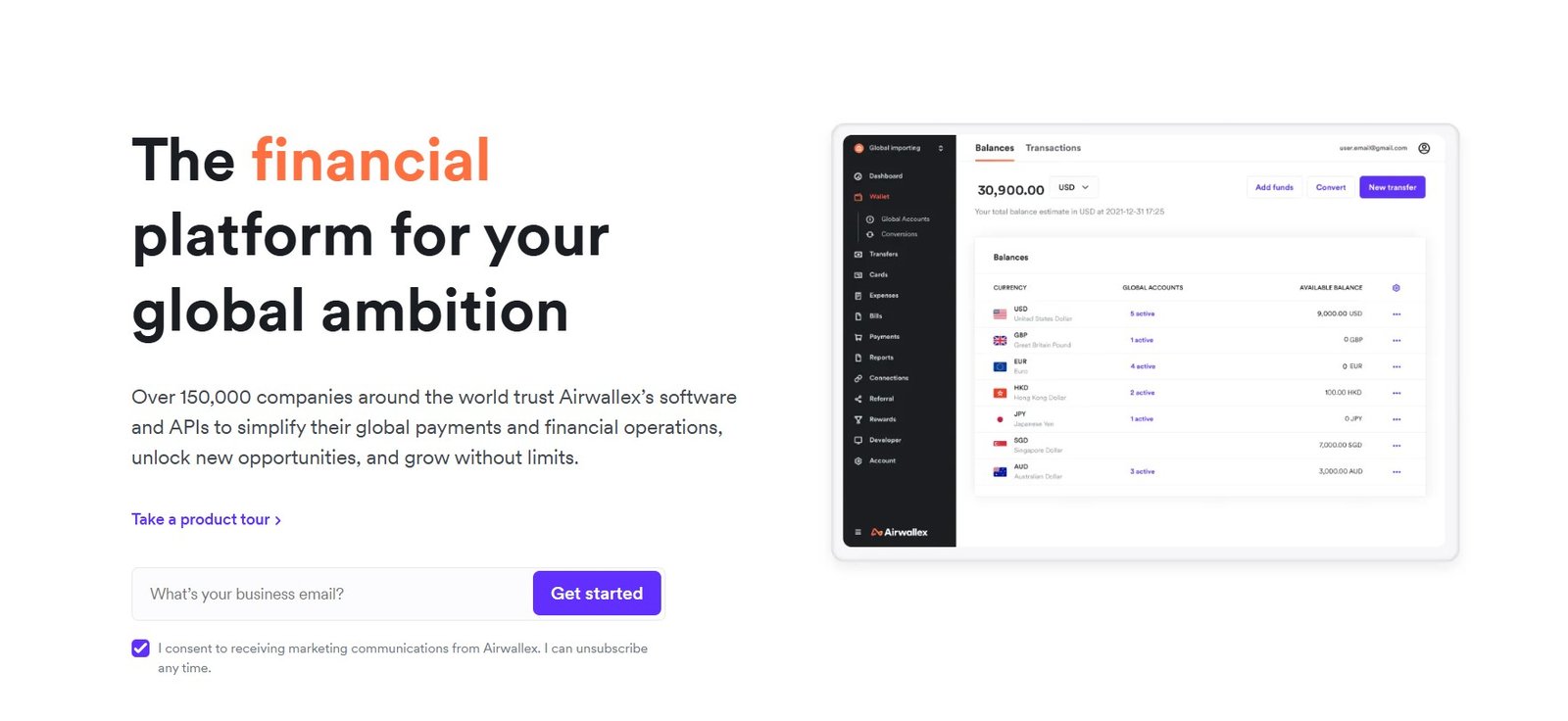

This is an honest Airwallex Business Account Review to help you decide the best virtual banking solution for your business.

When it comes to virtual banking for businesses, Airwallex is definitely one of options to consider alongside fintech companies such as payoneer, wise, etc.

Airwallex Pros and Cons

Before we share our verdict of this fintech company, here are some pros and cons you need to consider before opening a business account here.

Pros

Cons

Our Verdict

Airwallex is one of the best choices available in the market today for businesses operating internationally.

The platform provides a good experience for cross-border transactions, with fair pricing and a well-designed app.

Managing payments from around the globe can be tedious, with fluctuating exchange rates and transaction fees. Airwallex simplifies the process and makes managing global payments easier.

Their borderless cards are an excellent resource for employees who frequently travel abroad. The cards support numerous currencies and do not charge foreign transaction fees.

However, when it comes to customer support, they really need to do better. It is critical to any service, especially in fintech, where businesses seek to simplify their financial operations.

Also, be aware that the account opening process might feel a bit complex, as Airwallex will ask you to be KYC compliant, which might incur a bit of admin work. Still, I believe it is all worth it in the end.

About Airwallex

Airwallex was established in 2015 in Melbourne, Australia, is a multinational fintech company that offers a range of financial services.

Their core services include a multi-currency wallet that functions similarly to virtual business accounts, local and international transfer services, payment cards, and FX services.

The company has expanded to 19 locations worldwide and, while not a bank, is licensed and regulated in Australia, Canada, China, Hong Kong, Lithuania, Malaysia, New Zealand, Singapore, the Netherlands, the United Kingdom, and the United States.

Backed by Tencent, a major Chinese multinational conglomerate, Airwallex has secured over USD 900 million in funding from 25 investors across 12 rounds.

In late 2023, Airwallex embraced AI by launching a new generative AI tool to improve the customer onboarding process, helping customers get started faster.

Building on this in 2024, the company is now focused on developing an AI tool to further enhance customer support.

READ ALSO: How To Open a Virtual Domiciliary Account with Grey & Get a Dollar Card

Airwallex Key Features

Who is Eligible for an Airwallex Account?

The basic eligibility criteria to open an Airwallex account are:

- Business status – Airwallex primarily services businesses and not individual users. Your business must be registered and have a physical address.

- Geographical location – Airwallex offers its services to businesses in various countries around the globe. However, due to varying financial regulations, the availability of services may vary from one country to another. Airwallex is supported in the UK.

- Business Type – Your business must not fall under their list of prohibited businesses, often including high-risk industries like gambling or weapons manufacturing.

- Age – You must be at least 18 (or the age of majority in your jurisdiction).

- KYC Requirements – You must complete a Know Your Customer (KYC) process. This includes providing identification and verification documentation for your business and its owners.

How to Open an Account with Airwallex?

- Visit Airwallex – Visit airwallex.com and click the “Get Started” Button at the top right of the homepage.

- Country and Type of Business – Select your country and your business’ status (company or sole trader)

- Details – Input your details: name, business email, and select a password

- Email Verification – After entering your personal information, Airwallex will send a verification email to the email address you provided.

- KYC – You’ll likely be prompted to provide additional personal and business-related information and documents. This might include proof of address, identification documents like a passport or ID card and business registration documents.

- Account Set-Up – This involves setting up security measures like two-factor authentication, linking your business bank account, and customizing your profile.

- Start Using Airwallex – Once you’ve completed this process, you can use the platform immediately.

If you are in Australia for example, you will need the following documents:

When you open an Airwallex Global Account in a specific country, you will get local bank and branch codes, as well as dedicated account numbers for that country, as if you had a local bank account there.

This setup allows you to collect payments easily in the currency of that country and any other currencies supported by the Global Account you choose to open.

You can open multiple Global Accounts. They are offered in the following locations:

- Australia: Collect funds in AUD.

- Canada: Collect funds in CAD.

- Denmark: Collect funds in DKK, CZK, CHF, GBP, HUF, MXN, NOK, PLN, RON, SEK, ZAR.

- The EU (SEPA area): Collect funds in EUR.

- Hong Kong: Collect funds in HKD, CNY, EUR, USD, AUD, CAD, CHF, GBP, JPY, NZD, SGD.

- Indonesia: Collect funds in IDR. (In most cases, IDR deposits will be converted into USD.)

- Japan: Collect funds in JPY.

- New Zealand: Collect funds in NZD.

- Poland: Collect funds in PLN.

- Singapore: Collect funds in SGD.

- The UK: Collect funds in GBP.

- The US: Collect funds in USD.

- The United Arab Emirates: Collect funds in AED.

With an Airwallex Global Accounts, you can receive payments from PayPal and popular ecommerce platforms, such as Amazon and Shopify, as well as through local and international payment networks.

For example:

- A USD Global Account in the US allows you to receive USD via ACH, Fedwire, direct debit, or the SWIFT network.

- A GBP Global Account in the UK supports payments via Faster Payments, BACS, CHAPS, and direct debit, but not SWIFT.

- A EUR Global Account allows you to receive payments via SEPA.

The available channels for collecting payments vary by region and are determined by Airwallex. You can find the details on this Airwallex Global Accounts details page.

Note that the Global Account itself does not hold any funds. It is solely for receiving deposits. All funds are stored in your wallet, which receives deposits from your Global Accounts.

READ ALSO: UK Business Formation/Registration Guide

Airwallex Fees & Charges

At the beginning of this article, I mentioned that Airwallex’s fees are transparent and straightforward, so here are some of the main charges you need to be aware of:

| Service | Fee |

|---|---|

| Global Account Opening | £0 |

| Multi-Currency Wallet | £0 |

| Local Transfer | £0 |

| SWIFT Transfer | £10 to £20 |

| Direct Debit Funding | £0 |

| FX Conversion Rate (USD, HKD, CNY, AUD, EUR, GBP, CAD, SGD, CHF, NZD, JPY) | 0.5% |

| FX Conversion Rate (Other Foreign Currencies) | 1.0% |

| Company Cards | £0 |

| Employee Cards | £5 per card per employee (5 first Free) |

| Expense Management Platform | £0 |

| UK Payments | 1.30% + £0.20 |

| EEA Payments | 1.80% + £0.20 |

| International Payments | 2.90% + £0.20 |

| AMEX Payments | 2.40% + £0.20 |

| Software Integration | £0 |

Airwallex Alternative

Is Airwallex Safe to Use?

- Identity Verification – To prevent identity fraud, You must share a government-issued identity document, such as a passport or a UK driving license, in order to register with Airwallex.

- Mandatory Passcode and Password Protection – Airwallex mandates a per-device PIN code to secure your app. Biometric features such as fingerprints or facial recognition are also supported. A personal password is required to issue company and employee cards, authorize payments, and manage allowances.

- Real-Time Card Controls – If you suspect any fraudulent transaction on your company or employee cards, you can freeze or cancel them instantly.

- Advanced Security Features

- Biometric Identification – Biometric features such as fingerprint or facial recognition provide a highly secure way to log in.

- 3D Secure – This adds an extra layer of security for online transactions. A push notification is sent to approve the transaction directly in-app.

- Virtual Cards – For additional safety while making payments online, you can use a temporary virtual debit card, keeping your main card details private and your bank balance safe.

- Financial Services Compensation Scheme (FSCS) – Eligible deposits up to £85,000 are protected by the FSCS, which means they are protected if Airwallex goes into liquidation.

Airwallex Business Account Review Summary

Offering innovative solutions that streamline cross-border business transactions, Airwallex is an alternative business account worth considering.

It’s in the same ballpark as something like Revolut, Payoneer, or Wise in that it’s a non-bank multi-currency account designed for companies offering across multiple territories.

It can help you unlock new markets, receive payments easily, and save money versus using an old-fashioned high street bank account.

Airwallex has the edge for e-commerce business with its ability to collect payments straight into your account with experiencing high conversion fees.

FAQs

Airwallex enables businesses to create and manage foreign currency accounts, make international payments and conversions, and issue their own payment cards.

They aim to simplify the complexities surrounding international money transfers, exchange rates, and payments.

Yes, you can seamlessly connect Airwallex with your existing business tools. It has a robust API for developers and offers integrations with popular business and accounting tools like Xero, NetSuite, and QuickBooks.

Airwallex also supports e-commerce platforms such as Shopify, making it easier for e-commerce businesses to handle cross-border transactions.

Airwallex is great for small businesses, particularly those involved in international trade.

The platform simplifies the process of handling cross-border transactions, which can often be complicated and costly for small businesses or sole traders.

Their competitive exchange rates and low fees can help you save money on international payments.

Yes, Airwallex is a secure platform. It is regulated by the Australian Securities and Investments Commission (ASIC).

It is also licensed and regulated in multiple other jurisdictions worldwide, including the UK, EU, US, and Hong Kong.

The platform uses advanced security measures such as two-factor authentication (2FA) and data encryption to keep your funds secure.

Ready to Level Up Your Business Skills?

Join my online school, Online Income Academy, for more expert guides, tutorials, and strategies to help you build a successful business. Sign up today!